https://www.panewslab.com/zh/articledetails/66krmxby.html

https://www.chaincatcher.com/article/2076704

We are authorized to publish

At a time when the crypto market is weak and VCs are slowing down their investment frequency, one emerging venture capital firm that is attracting a lot of attention with its high investment rate and exaggerated investment amounts is GEM Digital, which has invested in at least 16 crypto projects in the last six months (and its related fund GEM Global Yield), including Venice Swap, Naetion, KaJ Labs, Unizen, Unizen, H2O Securities, etc. The single investment amount exceeds $100 million, and the cumulative committed investment amount exceeds $1.6 billion, which is probably more than any other crypto venture capital institutions.

GEM Digital once again announced that it had signed an investment commitment worth $35 million with Travel Coin, a blockchain travel eco-project. Why would GEM Digital invest $35 million in such a market cap project?

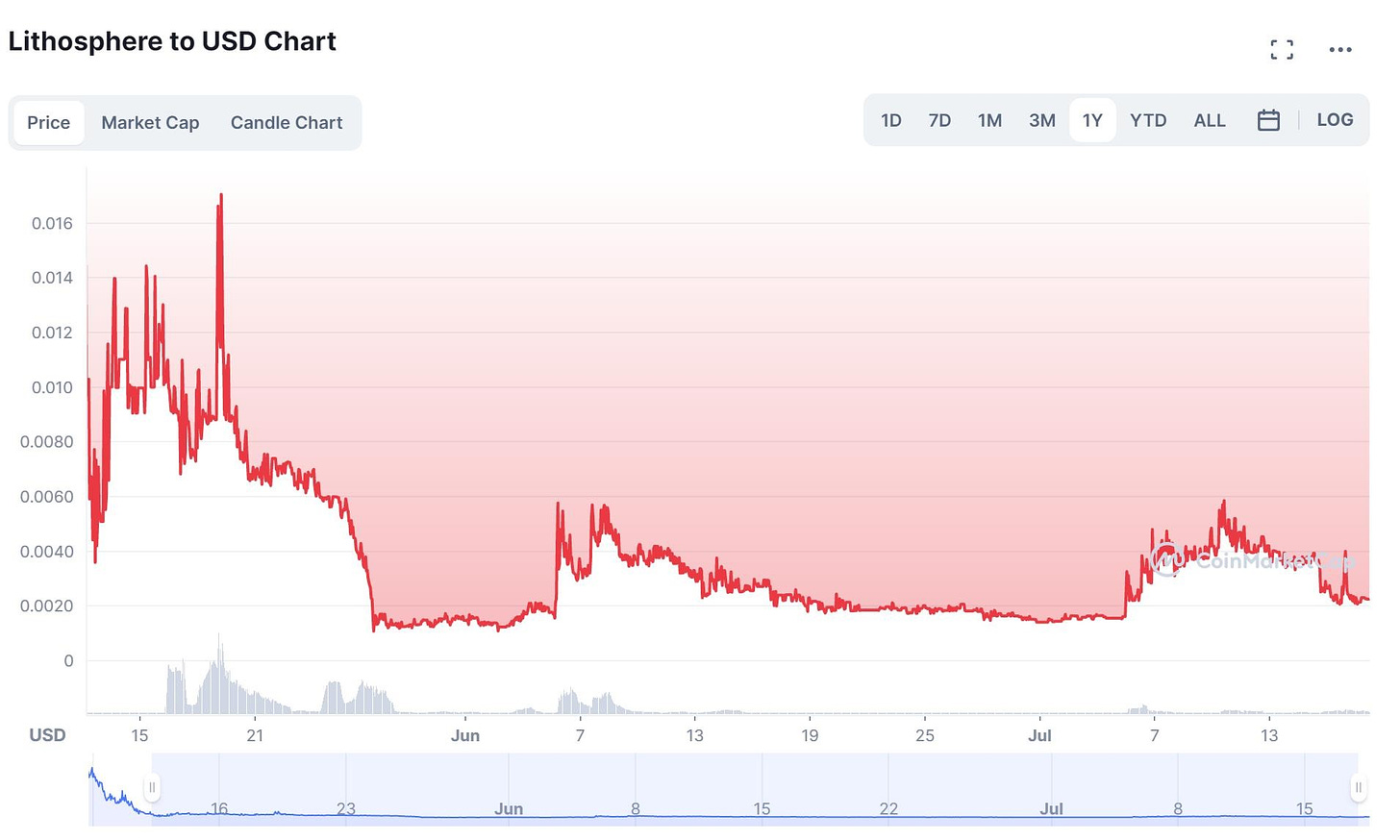

This phenomenon is not isolated. It has been the case with several of GEM Digital's previous investments. For example, on May 18, KaJ Labs announced a $400 million investment commitment from GEM Digital Limited, but the total diluted market cap of the project's token, LITHO, was only $4.7 million. This is also true for projects such as Peculium and Energi.

At the same time, most of GEM Digital's investments have very low industry visibility and no obvious highlights in terms of business models. Moreover, almost all of GEM Digital's investments have been made individually, not to mention in partnership with well-known venture capital firms, which is quite a strange style.

So, is GEM Digital just too rich for its own good? Why did GEM Digital spend a lot of money to invest in a project whose market value was far below the investment amount? The fishy thing is the word "investment commitment".

In contrast to most funding news, in which an investment institution directly announces an investment in a project, GEM Digital is basically announcing in the news that it is issuing an investment commitment. Literally, an investment commitment is a promise by the project owner to invest a specific amount in the project, but not necessarily to actually fund the project. In one GEM Digital investment news release, the project side had stated that the investment was not a direct investment, but would be based on milestones and performance to ensure that the use of funds was fully optimized.

But according to an interview with the head of a crypto project by Chain Catcher, the so-called "investment commitment" has a lot of jaw-dropping undercurrents. The project leader said that GEM Digital had contacted the project via email and promised to invest $50 million, but when she signed the investment contract, she found that the organization stated in the contract that it would not make direct payments, but would fill the investment with the profits made after the tokens were sold. In other words, GEM Digital's investment agreement is more like a cooperation and sharing agreement, where both parties sign a so-called huge investment agreement, create good news in the market, and then collaborate to make profits and share them. Judging from the performance of GEM Digital's past investment projects, this is basically the case, and it is the users who ultimately pay for the investment.

According to Coinmarketcap data, the price of the LITHO token quickly rose from around $0.008 to $0.016 after the funding announcement, but fell to around $0.0013 10 days later. Other tokens followed a similar trend.

"This is actually using the media to manipulate the community," said the aforementioned project leader, "I feel like a project with them would be miserable." Most of the news about GEM Digital's investment has been published on platforms such as Yahoo Finance and PR Newswire, but it has also been reported by mainstream crypto media such as Coindesk and Cointelgraph, and it can be said that half of the crypto media community has been kept in the dark due to the actual insider's bizarre and outlandish nature. GEM Digital did not actually originate the scheme, but rather from its parent company, Global Emerging Markets (GEM), which is officially described as a $3.4 billion alternative investment group that manages a range of investment vehicles focused on global emerging markets and has completed more than 500 transactions in 72 countries, with offices in with offices in Paris, New York and the Bahamas.

Specifically, the firm's investments include minority investments and control buyouts in many traditional sectors, including environmental technology, pharmaceuticals, agriculture, energy, and real estate development, but none of the portfolio companies are well known, and several Chinese companies have been named, including China Timber Resources Group Ltd, China PetroTech, Heng Xin China Holdings Limited, all of which are poorly documented after a search, with Hengxin China having been mandatorily delisted years ago. Of course, GEM's investment style is equally large, with most investments ranging from tens of millions of dollars to hundreds of millions of dollars, and its cumulative investment amount far exceeding the claimed $3.4 billion, while the word "investment commitment" appears in most investment news.

On July 15, CoinDesk reported that 5ire, a layer blockchain network, raised $100 million in Series A funding from Sram & Mram on the same day, valuing it at $1.5 billion.

5ire's official Linkedin shows a link to its own Crunchbase, a database of startup founders, employees, funding information and more. 5ireChain's Crunchbase page shows that 5ireChain's Series A funding was announced on February 14, 2022, by The Global Emerging Markets Group (GEM) and MH Ventures with a funding round of $100M. This figure does not match the investor and date of the Series A funding round announced to be completed on July 15.

Continuing to search for news of 5ire's funding in February, PANews found that THE ECONOMIC TIMES reported on February 15 that 5ire announced on that day that it had received a $100 million "investment commitment" from GEM Global Yield (formerly GEM) and This claim was also verified on 5ire's official blog, which on February 18 posted an article titled "5ire Raises $100 Million from GEM Global Yield LLC," which did not mention that the investment was an investment commitment. The article did not mention that the investment was an investment commitment.

This shows that 5ire's Series A funding was reported in February and now in July this year by different investment institutions. And as a public chain project, it also seems bizarre that it is seeking an IPO even though it has not yet officially launched.

The above information suggests that 5ire may have been "pigeonholed" by GEM once, or put on a joint "show", and in the cooperation with GEM, 5ire's official blog does not state that this is an "investment In the cooperation with GEM, 5ire's official blog does not state that this is an "investment commitment" and has not been modified as of July 18, which is suspected of releasing false good news.

The official Twitter feed of Sram & Mram, a solutions and services company, is not reported on its website, Twitter, Facebook, Instagram, Linkedin, etc. Sram & Mram's official Twitter feed has only 120 followers. Is this another show?

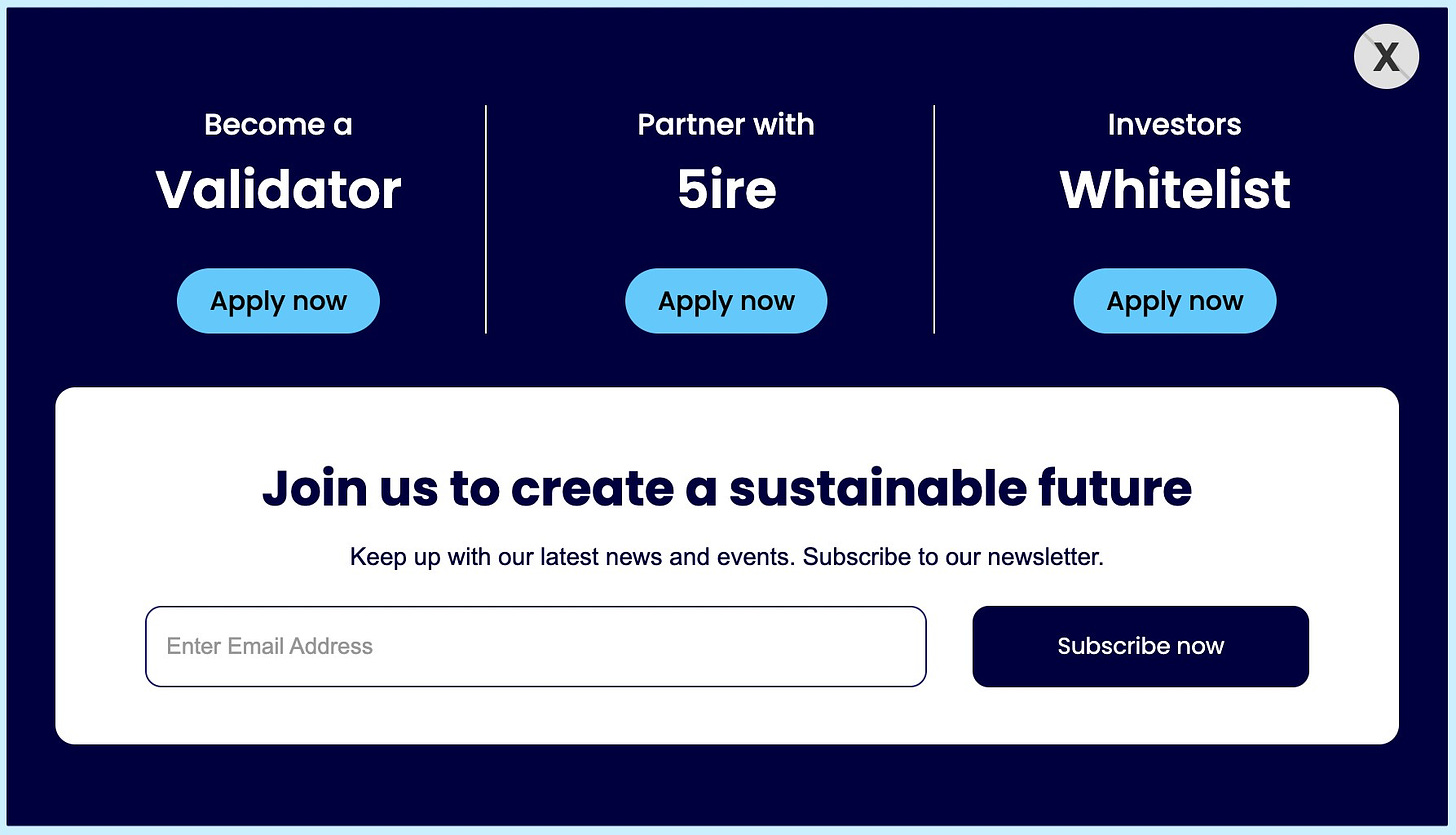

5ire has already reached out to retail investors. Every time PANews logs on to 5ire's official website, a pop-up window to request an investor whitelist appears. If the $100 million financing is true, 5ire has no need to be in such a hurry to raise funds from retail investors through this marketing tactic.

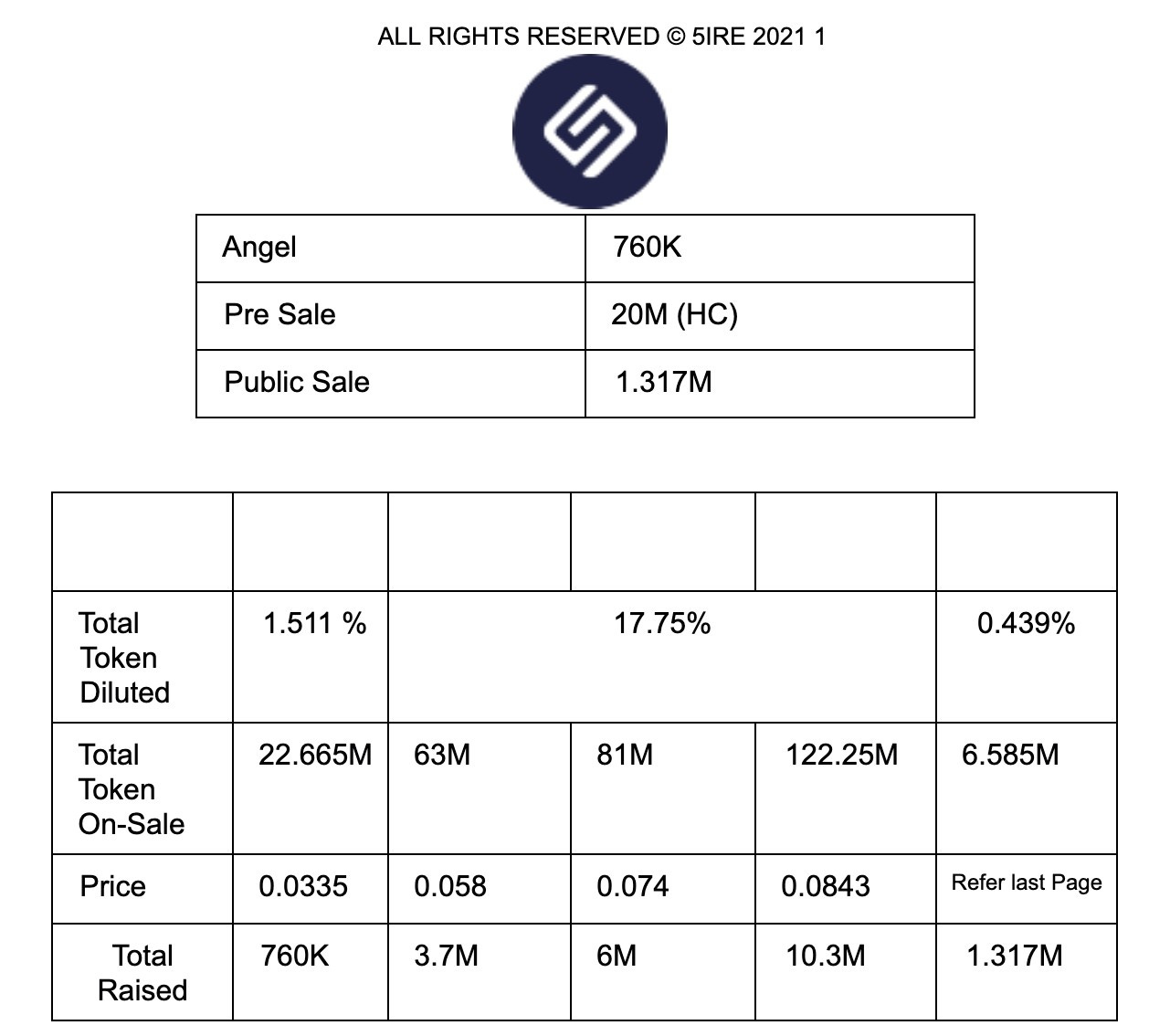

The link to the token model remains on the whitelist application on the project's official website, and the contents therein do not match the announced funding amount and valuation. As shown in the chart below, according to the relevant content, 5ire plans to raise a total of about $22 million. 5ire tokens total 1.5 billion and are valued at about $126 million if calculated at the last round price of $0.0843 before the public offering, and about $450 million if calculated at the third round public offering price of $0.30. This is completely different from the valuation reported by the current media.

There are many contradictions in the official information of 5ire and the financing news reported by the media.

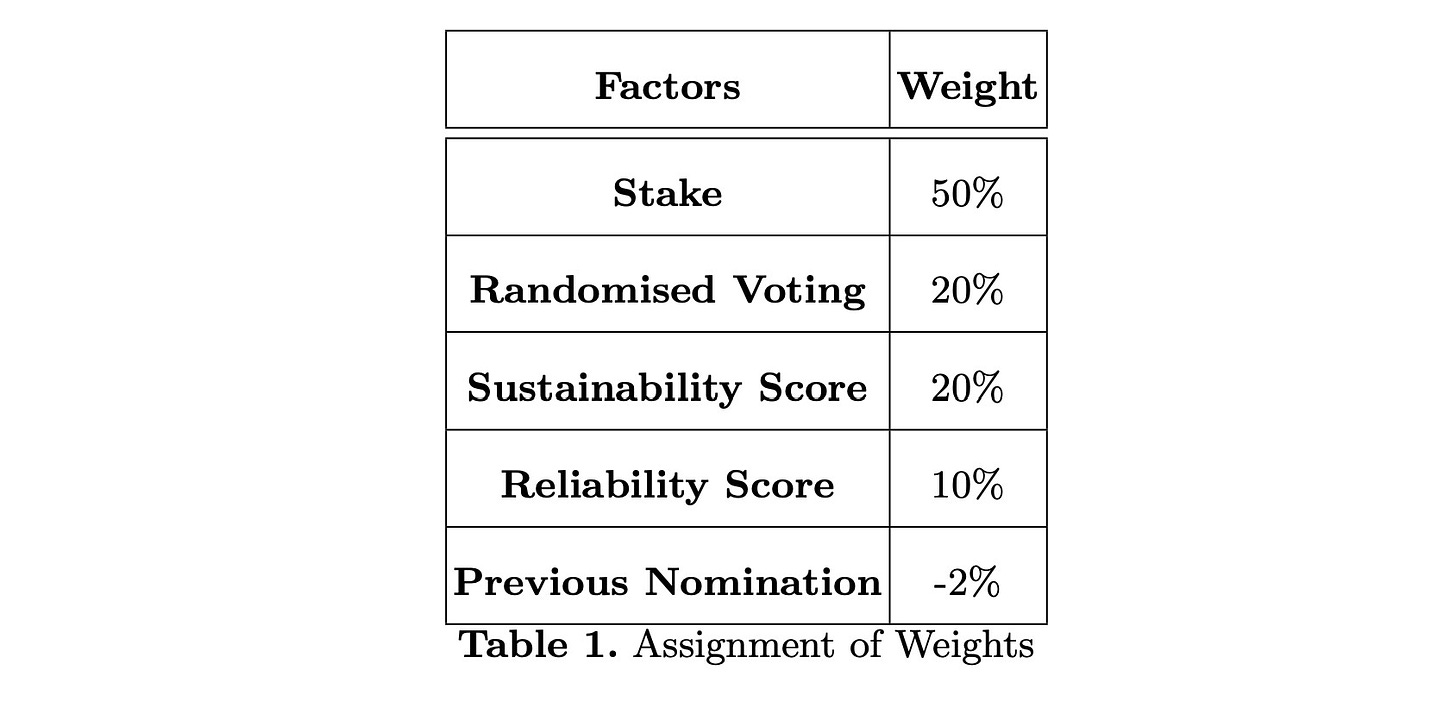

Keep looking for information about the project on the official website. Compared to other blockchains, 5ire is characterized by sustainability and is able to meet the UN's sustainability goals. 5ire's consensus mechanism has sustainability as one of the most important components, and its consensus is called SPoS, where the weight of nodes packing blocks depends on four factors: pledge, reliability, random voting and sustainability score, and the node with the largest score will be responsible for the subsequent 12 hours of block packing. This can be thought of as a variation of the existing PoS consensus mechanism, with the addition of a sustainability score. So, how is 5ire's sustainability score calculated?

As described in the whitepaper, the sustainability score consists of an environmental, social and governance (ESG) score. Initially, this score will be assigned based on data obtained from trusted institutions. After the 5ire ecosystem is stabilized, there will be a decentralized mechanism to assign and update the sustainability score, allowing nodes to periodically update the sustainability scores of participants. The following table shows the ESG judging factors.

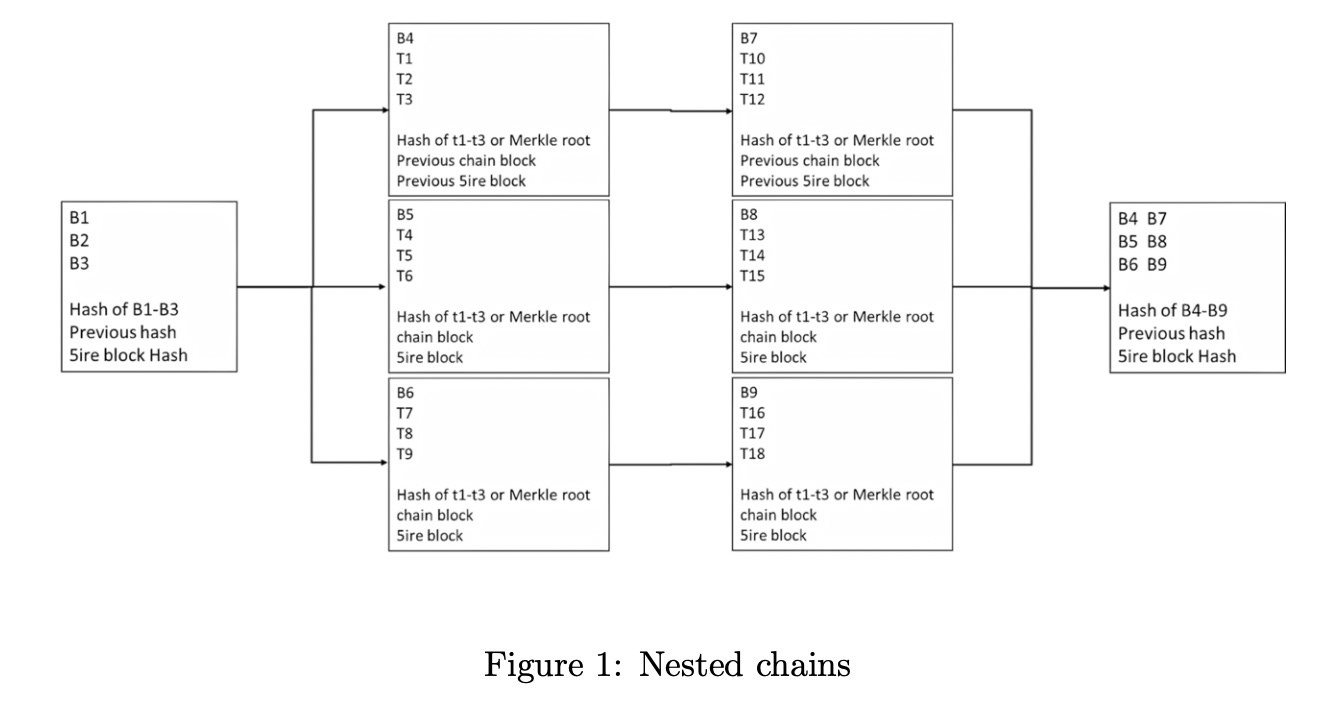

In addition, 5ire introduces the concept of nested chains, similar to parallel chains, to address scalability issues. Nested chains are created according to the network load requirements and once created, they will remain on the nested chain to continue outgoing blocks until the chain is added to the blocks of 5irechain. The structure of a nested chain is shown in the diagram below. Each chain corresponds to a pool of transactions, which is split into two pools once the number of transactions in the pool exceeds a threshold. When the number of transactions in the pool decreases, it can be merged into one chain again.

Because of the concept of sustainability, 5ire calls itself the "fifth generation of blockchain", corresponding to the "fifth industrial revolution", which focuses on guiding technology to serve humanity, and 5ire can build a user-centered sustainable ecosystem by addressing environmental sustainability. 5ire can build a user-centered sustainable ecosystem by addressing environmental sustainability. In our understanding, the industrial revolution corresponds to technological breakthroughs and can lead to efficiency gains. 5ire, on the other hand, only introduces the concept of sustainability and threatens to call itself the next industrial revolution.

In terms of technology, the concept of parallel chains has been applied in Polkadot. Because the number of chains in 5ire is variable, this scheme may be more difficult to develop than the current common scaling schemes.

In the official 5ire blog, there are numerous articles devoted to basic concepts such as the interstellar file system, data security, DeFi, and how the Merkle tree works, and nothing related to 5ire is mentioned in these articles at all.

The partners and investors announced on the official website contain 68 logos, but the logos related to Sram & Mram and The Global Emerging Markets Group mentioned in the above funding news are not found, while DAOStarter, ARDURA and other logos are repeated. This not only increases the possibility that the funding news is fictitious, but also appears to be very inattentive on the part of the project.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish