Talk with CryptoQuant CEO ki young Ju: The future of Ethereum, and is it a bear market now?

0:Please Ki Young Ju introduce CryptoQuant and say something to Chinese community.

CryptoQuant offers retail investors better visibility of their investment by offering data services.Most crypto investors have anxiety when they invest in cryptocurrencies because they are struggling with hurdles for data-driven investing. Without data, crypto investing would be gambling. That's where CryptoQuant comes in.

We started as a data provider, and now we're on the mission to make the crypto markets work for all people by giving them digestible data and community-driven insights.

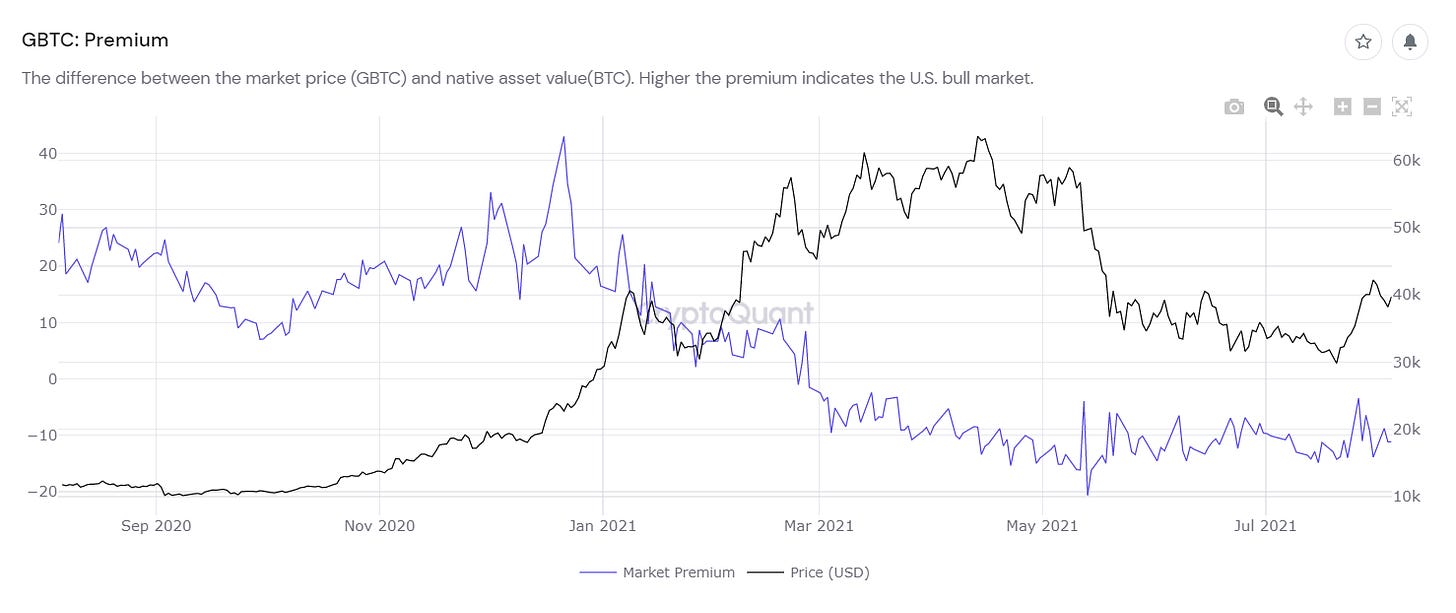

1:GBTC has been negative premium for a long time. How do you view this situation? How long will the negative premium last?

I think the main reason for this negative premium is that people think Bitcoin ETFs would be approved any time soon. If ETFs are approved, people don't need Bitcoin Trust products anymore.

This situation might imply most institutions think Bitcoin ETFs are approved within a year. Also, the way to purchase Bitcoins by institutions is changing from indirect purchase to direct purchase like Tesla, MicroStrategy, and so forth.

They don't use Grayscale products to purchase Bitcoins, but they use Coinbase Prime, OTC desks, Custody products for direct purchasing. So you might don't want to interpret this data as "lowering interest for institutional demand". It might be, but not necessarily.

2:The current Bitcoin price deviates greatly from the price predicted by the S2F model. Is the S2F model still worthy of trust?What do you think of the predicted price provided by the S2F model.

I think S2F model is flawed in terms of the demand side. This model is based on scarcity and scarcity is about the supply side. That's why the current BTC price deviates greatly from the price predicted by the S2F model.

For example, aggregated BTC reserves for all exchanges have both supply/demand-side factors. If people want to sell BTC, they would send it to exchanges. If not, they(mostly whales) would withdraw from exchanges to custodian wallets.

If PlanB adds some variables to see demand-side factors, the model can be more accurate I think.

3:EIP-1559 will be launched today. What can it bring to Ethereum and even the entire cryptocurrency market?

Yes. I believe this EIP-1559 would be a game-changer. Lowering fees can solve the blockchain trilemma, improving scalability, security, and decentralization. Currently, all the DeFi services, NFT markets, blockchain games are running with unreasonably high fees.

If we can use those services with very low fees, the number of transactions would increase, and network activeness normally increases the value of the blockchain, making the price going up in the long term. Not sure the short-term price moving tho.

4:There is such a voice in the market that the rise of Ethereum and other blue-chip DeFi will break away from the shackles of Bitcoin and lead the market to a new peak. Do you think this situation is possible? If so, could it happen in the rest of the year?

I think Ethereum might flip the Bitcoin market cap in the long term, but not this year. This bull run has been driven by the narrative "institutions coming to crypto market". This trend may last to next year. Without institutional demand, Ethereum can't flip the BTC market cap.

I met Goldman Sachs, Fidelity, and other big institutional asset management firms in Miami a few weeks ago and they said they're still struggling with explaining what is Ethereum/DeFi to their bosses. I think it takes a few years to build institutional adoption for Ethereum/DeFi projects.

5:Metaverse is very hot recently, can you tell me your opinion?

Every terminology like NFT, AR/VR, games, and so forth is called Metaverse these days. I think it's just NFT and play-to-earn games. Both have big upside potential within a few years for sure. But building a metaverse could take some time as a few years.

6:The last one is very boring, but the one that everyone is most concerned about, do you think it has entered a bear market?Do you think it is possible for Bitcoin to set a new high in the rest of the year? How to judge the price trend in the second half of the year?

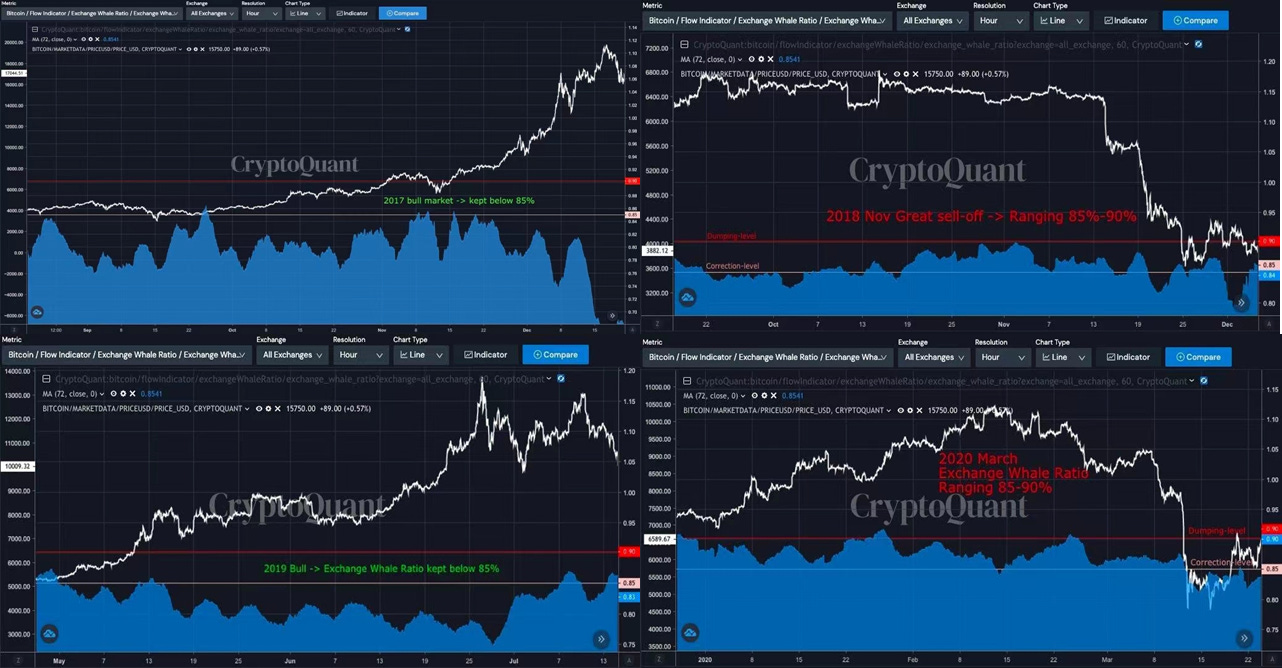

Great question. I think the market is still a bearish trend, and exchange flow indicators like Exchange Whale Ratio says whales are still depositing big chunk of BTC to exchanges.

If the whale ratio is ranging 85%-90% the market is likely to be bearsh or going sideways

But the problem is that someone(s) is buying Bitcoins outside of the exchanges and there's a possibility that the big names can announce their purchase anytime soon.I think, for the time being, the market is good for scalping. If you are a long-term holder(over a year), you can stack some Bitcoin here, but as a trader, I'm not going to hold my positions longer in this market.

Selected audience questions

1:What do you think of the future growth space of the nft market?

I think there are three things driving the NFT market:1. Metaverse(+Games);2. Purchasing arts/monuments;3. Money laundering by purchasing NFTs.

Number 1: has a big upside potential but it takes a few years to build the entire metaverse and launching more successful games.

Number 2: is working well these days, it would be huge if we can penetrate the traditional art markets like Sotheby's

Number 3: I believe some of the big purchase for NFTs are for money-laundering. It's a starting point for bigger digital art market.

Overall, I believe NFT market will become huge within a few years.

2:Gamefi has become popular, but there is currently no killer game in this field. Do you think that subsequent killer games will developed by professional game companies? Or by a blockchain company?

I think the traditional top-tier game companies are not going to launch decentralized blockchain games because there's no advantages to change their database to blockchain. Their revenue might decrease if they decentralize the games.

I think second-tier and new startup game companies can launch decentralized games, but I don't see any profeesional teams at this moment.

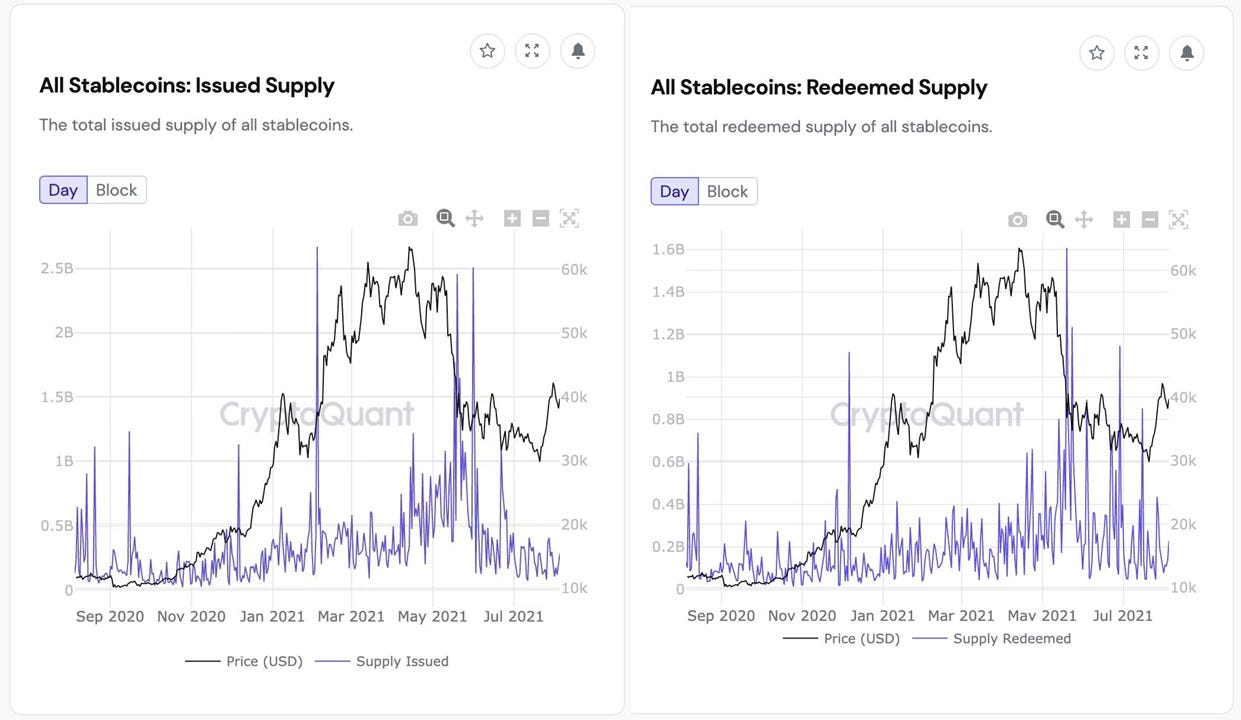

3:Recently, the issuance of stablecoins has slowed down. What do you think it means? Is there any other data that can reflect this trend?

Many stablecoins are redeemed these days. BTC needs more stablecoins or fiat on-ramps to break new ATH, but the trend looks like redeeming stablecoins and less issued stablecoins.

I think there are two bullish cases:

1. Big names announce their BTC purchase (e.g., Apple)

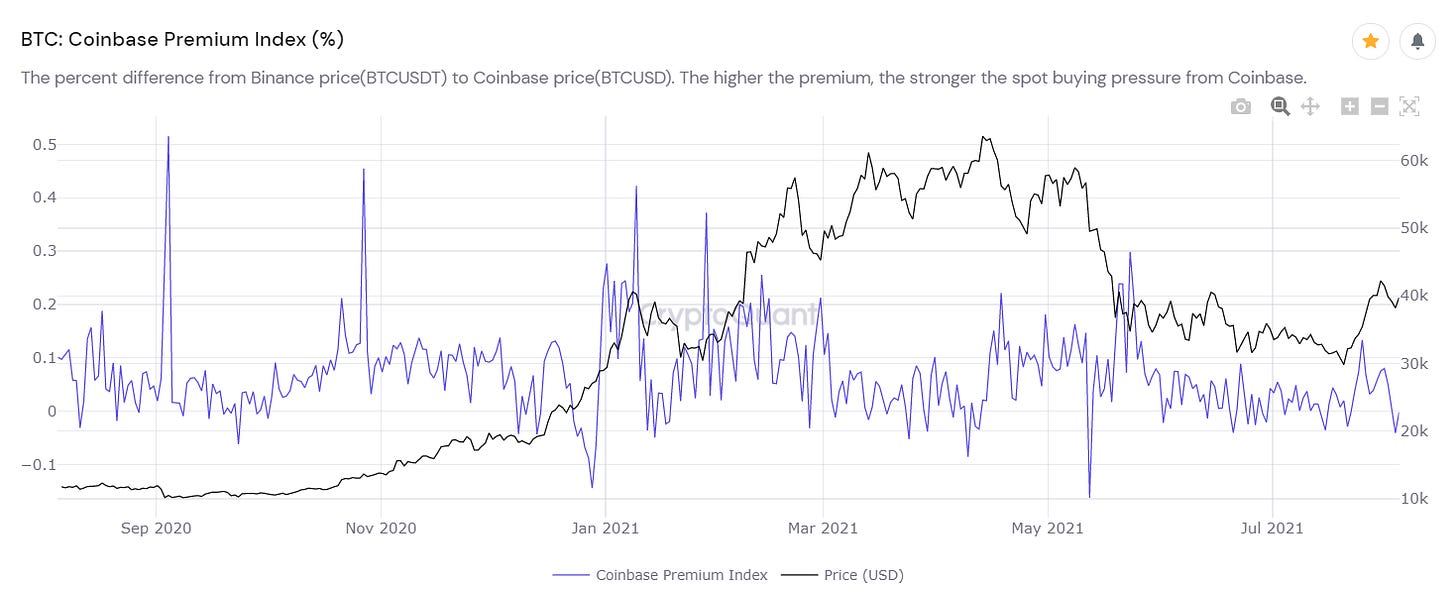

2. Retail investors buy BTC with their local fiat currencies(I think it would be mostly US people) You can see Coinbase premium to see this trend (the price gap between Binance BTC/USDT pair and Coinbase BTC/USD pair)

4:What do you think are the three most effective indicators for measuring market bulls and bears?

Not a single indicator can predict the future for sure, but I mostly use Whale dumping indicators(e.g., Exchange Whale Ratio(72h MA), All Exchanges Inflow Mean (24h MA), exchange netflows, and stablecoins ratio to determine whether it's bull or bear market.

Thank you Ki for your patience.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish