While the war in the FT trading market set the tone with the defeat of SBF and the fate of FTX facing bankruptcy, the war in the NFT trading market is also being fought quietly. This is a war caused by royalties, but not only about royalties, but also about the survival of the platform, project revenue and the three-way game between the platform, project and users.

This post is sponsored by Muverse

The Muverse Headphone blind boxes airdrop as well as the Muverse DApp Android public beta will launch at 8:00 am EST on Nov. 29th. 9,999 Headphone blind boxes will airdrop to users who stake their NFT at Muverse.

For the details, you can visit here

About Muverse

Muverse is a community-driven Web3.0 interactive music platform. We have elected to democratize the music industry by empowering web3.0 music communities where fans are able to directly interact with , invest in and support their idols as well as earn financial rewards.

Origin of the war

For a long time, royalties were bound to be paid, until SudoSwap caught fire in August. However, at the time, people tended to get caught up in the discussion of SudoSwap with its clever SudoAMM mechanics and potential airdrop opportunities, mostly ignoring the fact that it set a precedent for royalty-free access.

The royalty issue really exploded in the community with X2Y2’s “forward-thinking” move to introduce a custom royalty feature that allows buyers to choose to pay 100/50/0% royalties on NFT purchases. When the news broke, crypto artists and some NFT project owners and KOLs at home and abroad quickly exploded, accusing it of arbitrary behavior. Although X2Y2 did not start the whole thing, the community discussion is still focused on X2Y2. Perhaps thanks to the pressure and motivation, X2Y2 quickly went live with an instant voting system on the NFT trading interface and returned the decision on royalty settings to each NFT community itself. X2Y2’s decision was undoubtedly the right one, and while the voices of the royalty debate are gradually being recycled into each community, the seeds of the royalty conflict are also taking root within the community.

A few days after the X2Y2 feud was winding down, Solana NFT market leader Magic Eden announced the launch of MetaShield, a royalty protection tool that helps identify Solana NFTs that bypass royalties to list and trade on the marketplace and take appropriate actions including updating metadata, flagging NFTs or blurring images to protect NFT project contract owners from royalties. A month later, after Solana leader NFT DeGods announced it was adjusting its royalties to zero, Magic Eden also introduced optional royalties, allowing buyers to choose all, half or none. The decision was also controversial in Solana NFT players.

In late October, LooksRare announced the launch of Optional Royalties, which allocates 25% of the 2% agreement fee charged, or 0.5% of the transaction value, to project contract owners at the expense of LOOKS pledge rewards, and rebalances the reward factor for transaction mining from 50% for buyers and 50% for sellers to 95% for sellers. LooksRare has thus become the first zero (optional) royalty marketplace to support creators by directly sharing agreement fees.

Blur, launched by Paradigm, is a customizable royalty-free NFT aggregated trading marketplace. With a smooth and professional trading experience and the potential for short sale expectations with pending orders, Blur greatly dominated the two hotspots Art Gobblers and KPR in terms of trading liquidity and pending order depth in the late October and early November days, beating OpenSea to become the most traded platform in a single day without wash-trade for several days in a row.

OpenSea, the long-time leader in the NFT trading market, is not sitting still in the face of the many challengers. On November 6, OpenSea published an article discussing the NFT royalty solution and launched an on-chain enforcement tool for NFT royalties, which requires project contract owners to block their shelves from the zero-royalty marketplaces Blur, LooksRare, X2Y2 and SudoSwap. With the launch of OpenSea’s royalty enforcement tool, the NFT Marketplace war, which originated with royalties but is not limited to them, has been officially waged.

X2Y2, which has been the most vocal about optional royalties, announced on November 19 that it is using OperatorFilter to remove the “flexible royalty” setting from all new NFT launches and will enforce royalties on all NFT series. X2Y2 said, “OpenSea deserves our respect for bravely defending royalties at the risk of losing market share.”

The trigger and the heart of the war

The war in the NFT marketplace revolves around royalties. NFT royalties need to be set manually by project owners on each platform, but many project owners relied on the early liquidity of OpenSea and tended to set them only on OpenSea. Optional/zero royalties were born when the “Sybil” platform of OpenSea realized that royalties would not significantly harm the platform and projects, but would also give users access to the appropriate NFTs at a lower cost. There is no reason why users should not choose a zero-royalty marketplace to trade in, provided that the depth of the transaction is reasonable. If a zero-royalty platform can partner with a project that is still hot before the NFT is launched, the platform can also have a greater degree of transaction depth and liquidity of the partner project, and the degree of correlation between the two is not particularly strong, mainly social media assistance to promote, platform placement on the front page, etc. Some project owners are willing to cooperate with zero-royalty platforms not only because of the greater publicity traffic brought by the platform, but also because the projects may not have made long-term plans or do not intend to do so before the launch, and the focus is not on NFT.

(1) Short-sightedness of project owners

An NFT goes from zero to live in about 2–3 months. The current average MINT price of NFT is about 0.06 ETH, if 6,666 units are issued, then the project can earn 0.06 × 6666 = 399.96 ≈ 400 ETH, which translates into a current price of about $450,000–500,000. The cost of outsourcing the operation team, the market price for 2–3 months of operation is about $100,000-$150,000, after subtracting this cost about $300,000-$400,000, and then subtracting the miscellaneous expenses of $50,000 for these 2–3 months, a project side team can earn about $250,000-$350,000 after the launch of NFT. An NFT core team of no more than 5 members can earn $50–70,000 in 2–3 months, which is equivalent to 1–2 years of salary for an average person. If the core team already has marketing talent, the actual income will be higher after eliminating the need to outsource operations. What’s scary is that this model can theoretically be recycled forever for the next project. Every once in a while, a new Twitter, Discord, etc. can be relaunched with a new look. Royalty income as a secondary stream doesn’t mean much if the project doesn’t have a long-term business plan in place.

(2) Involution of the platforms

The more in the trough of trading volume, the more NFT trading platform. Bear layout, bull harvest, the same can be applied to entrepreneurs. NFT market size even at its peak market value is only about $ 30 billion, less than the market value of a top five FT, but the valuation of the NFT market is often touted, such as Verified Market Research that the NFT market size in 20230 will reach $ 231 billion; Morgan Stanley predicts that the NFT market size in 2030 will exceed 500 billion, etc. Entrepreneurs entering the layout of the NFT trading market, most of them are looking at the future prospects, want to get a share of the future of this hundred billion or even trillion level market. However, placed in the current market of daily trading volume of only ten million dollars, the number of platforms has been outrageous. Currently there are only about 10 NFTs with a certain trading volume and a floor price over 10E, but there are far more than 10 NFT trading markets. There are 25 on one page of DappRadar’s list of ETH Marketplaces, for a total of 5 pages.

Platform revenue is mainly in transaction fees, OpenSea is 2.5%, as the “witch” platform of OpenSea, LooksRare is 2%, X2Y2 is 0.5%, and the latter platform will basically maintain the fee at 0.5%, until the emergence of Blur to change the fee to 0. The fees are a product of the first major involution. Incentives such as trading mining and listing mining are used to increase trading depth and volume, stimulating the growth of volume to make up for the lack of unit price, thus also allowing the platform to maintain a good income. However, in the bear market, liquidity and trading volume waned and new platforms emerged to replicate the former’s approach, the advantage of lowering fees gradually disappeared. Royalties then became another product of involution after fees, as platforms hoped to draw depth and volume growth by lowering user purchase costs, but this was to the detriment of project owners. It is not appropriate for the platform to make a “one size fits all” decision, and it is clear that the decision should be left to the community. Marketplace+ aggregators also exacerbate involution, with platforms relying on aggregators to attract liquidity from other marketplaces, and relying on incentives to keep users from other marketplaces to trade on their own platforms.

Originally, involution was not spreading to OpenSea until Blur showed its strong and threatening side. OpenSea has always been the leader and a challenge for all major platforms. Even in the midst of the market winter, OpenSea still holds the majority of the market share, leaving aside wash-trade. Its main advantages are the visibility of first-mover advantage, which brings trading depth, and the joint development with Blue Chip NFT in the market for more than a year. Share weal and woe, Blue Chip has a high stickiness with OpenSea trading, which is the foundation of OpenSea. With trading/listing mining, the likes of LooksRare and X2Y2 have decent trading volumes on the surface, but once combined with the transaction counts and active traders it is possible to glimpse the fake component behind the boom. While it is true that some NFT listings/trading depths have been tapped, such as DeFi OG’s deeply involved NFT projects having more appeal in LooksRare; X2Y2 becoming a gathering place for Chinese projects; domain name depths having more advantage on Element, etc. But the strong competition from almost all the “Sybil” platforms on blue-chip deals, which account for most of the volume, was mostly focused on the first few days of the incentive rollout and did not shake OpenSea’s foundation in the long run.

But Blur, a royalty-optional aggregated trading marketplace, with its 0 processing fee, potential airdrop for pending orders, smooth trading experience, and Paradigm title, has made a strong case for competing for volume on Art Gobblers, which has blue-chip properties. Since the launch of Art Gobblers, Blur has been going head-to-head with OpenSea and has not lost out. Of the 10,000 ETH transactions generated in the first 3 hours of Art Gobblers’ launch, OpenSea accounted for 52% and Blur for 43%. Since November 2, Blur has overtaken OpenSea in terms of Art Gobblers volume and beat OpenSea in total volume for several days in a row without a wash-trade in the same situation. Despite the eventual fall of Art Gobblers and the consequent decline of Blur’s trading volume, it still maintains a daily trading volume of over 2,000 ETH with zero wash-trade, which is almost 90% of the combined trading volume of all other trading platforms except OpenSea. In addition, in November, 50% of the volume of premium NFTs such as BAYC, CloneX, Azuki, Otherside, DigiDaigaku and Potatoz fell on royalty-free platforms, with a large portion of that volume captured by Blur.

OpenSea is losing out in the race for potential blue chip Art Gobblers, and is increasingly losing deals to royalty-free platforms, threatening its very existence. It needs to retain as much depth and liquidity as possible in its high-quality projects and not lose them easily. Therefore, joining the royalty war is a natural choice. OpenSea understands that even the best projects are currently facing difficulties in making a sustainable profit, so it is maximizing the protection of royalties, which are almost the only path to sustainable income, by introducing a royalty enforcement tool. However, the enforcement of this tool requires blocking the market for optional royalties, which maintains the liquidity and depth of OpenSea transactions while shifting the conflict to the project and its community — the project owner wants royalties as the only way to generate revenue, while users want to buy at low cost; the project owner caters to the community for lower or zero taxes, while the project owner’s profitability is greatly reduced or even reduced for the community. The project’s revenue is greatly reduced or even zero, and its development prospects are limited.

(3) The three-way game of platform, project owner and user

In a bear market, the trading market suffers far more than any single NFT project side. Some of the older OpenSea “Sybil” platforms are subject to “Sybil” attacks by those who come later. Newer platforms are absorbing the innovation and experience of their predecessors and aggregating their liquidity at lower fees. After putting their own income down to a certain level, the platforms start to think from the perspective of project parties or users, but they are not yet able to balance the two without harming their own interests.

The development of quality projects cannot be achieved without sustainable revenue to cover basic expenses, operations and innovation costs. The current NFT project’s sustainable income comes almost exclusively from royalties. As a long-term development plan for the project, after the launch of NFT, if there is no sustainable support of royalties, before the initial sales run out of money still to find external revenue channels, then the project can basically be declared a failure. Especially for the free mint project, it is unreasonable to deprive it of royalty income and require it to generate electricity for love. In addition, with the proliferation of NFT, responding to the community’s call for optional royalties or zero royalties may not necessarily bring a qualitative leap forward for the project.

There is nothing wrong with users keeping their purchase costs as low as possible during a downturn in the market. When you are interested in a project, you hope it will bring a greater return on investment in the future, but you are not willing to pay royalties for it, which is tantamount to depriving the project of the necessary funds to maintain its operation. A project without a guaranteed income will not be able to generate higher value for the future of the project.

The trend and future of the war

The current landscape is clear: OpenSea is more inclined to protect project owners, but whether to use royalty enforcement tools depends on the final decision of project contract owners; LooksRare wants to find a balance between project owners and users, allocating part of the agreement fee as compensation while taking optional royalties, but to the detriment of the platform and stakers; Element, Blur, etc. are more on the side of users and are firm on optional/zero royalties; X2Y2 is more like a fence-sitter, changing its position with the situation.

The author’s view remains that, at present, as almost the only means of continuous income for project parties, royalties are bound to be paid, but not any NFT royalties are worth paying, and the reasonableness of royalty rates for different projects needs to be determined by the platform party setting rules to provide a reference range to guide the community to make a reasonable choice, as well as to protect the vulnerable party among different subjects.

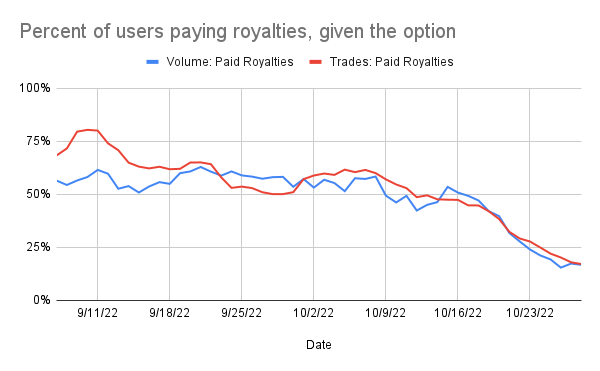

Based on this view, I believe that the current optional royalties, which are entirely up to the buyer, are unreasonable. As a rational economy, buyers always want to get more back at a lower cost, and royalties are one of the major costs. Once royalties become optional, a rational economy will not hesitate to turn them down to zero. This was confirmed by Proof Research Director NFTstatistics.eth, which said on Oct. 28 that data on optional royalty NFT transactions greater than 0.1 ETH showed that the percentage of NFT buyers paying royalties on X2Y2 in the case of optional royalties has dropped from 75% a month ago to 18% today. This number is expected to drop further as more buyers become aware of the option of 0 royalties. Opensea also recently said that 44% of the top 20 NFT series in the last week had no royalties paid on their volume.

On the other hand, as more and more platforms support optional/zero royalties, it will also force some long-running project owners to find a sustainable revenue path beyond publishing taxes in a timely manner. But having more means to generate revenue doesn’t mean that royalties are less important; more ways to generate revenue means that the value of giving back to the community is more diverse and no longer just about trying to make the floor price grow. In addition, trading platforms are facing a transition to service platforms, not only providing trading, but also taking on more responsibility to provide services and protection, such as guidance on the reasonableness of royalty rate determination, deprivation of royalties for Rug Pull projects or transferring communities.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish