Original link: https://mp.weixin.qq.com/s/ojgTUSDCz-2QdSpBejI6jw

It took FTX two years to sit on the second-in-command position, but it fell to the altar overnight. The valuation of tens of billions was like a bubble in the pan. Just like a boulder fell in the middle of the lake, making everyone on the Crypto boat feel uneasy.

The star VCs who invested in FTX also suffered heavy losses. Sequoia Capital’s 200 million investment impairment was 0, and Temasek’s $320 million FTX shares were worthless.

Paradigm’s $215 million investment has been its worst failure in recent years.

If we turn the clock back more than ten years ago, back to the era when Bitcoin was just emerging and full of encryption naivetism, and look for early VCs, we can see that the few VC (Venture Capital) institutions were barren at that time. Some seeds were discovered in the barren and unknown early industry, some grew into later towering trees, and some were quickly forgotten in the extremely fast-growing Crypto industry.

This is Crypto, where time accelerates. Incubation, growth, iteration, extinction, and a new round of ebb and flow often happen overnight. The dramatic changes in Crypto are reflected in every corner of the industry. Looking back at the huge earthquake of FTX after a few years, perhaps it is just a small wave.

Twelve years ago in March, with the emergence of the world’s first cryptocurrency exchange bitcoinmarket.com (now defunct), the door to bitcoin trading was officially opened. In July of the same year, the word blockchain also appeared for the first time on the BitcoinTalk forum (formerly known as Proof-of-Work chain). In the future, this name has become the core vocabulary representing cutting-edge technology. At that time, there was no real Crypto Venture Capital involved in this industry, and most of them were individual investors or some capital with a keen sense of smell.

a16z, a legendary investment institution in Silicon Valley, did not make its first investment in the Crypto field until April 2013. It invested OpenCoin, a San Francisco start-up company focusing on mathematical currency payments. After that, the company not only became the top player in the field of cryptocurrency, and also had a protracted confrontation with the US SEC. At this stage, with the expansion of Bitcoin’s influence, many research companies and VC institutions have emerged around Bitcoin’s payment applications.

After 2016, Ethereum began to mature gradually and opened an era of crazy ICO. As a brand-new financing method, the emergence of ICO seemed to allow entrepreneurs to find a way not to rely on VC. In the upsurge at that time, institutions and individuals were investing in the BTC/ETH currency-based way. With the further development of the Crypto industry, VC itself was also evolving rapidly. The update of investment concepts, the entry of traditional VCs, and the rise of native encrypted VCs were all working together in this capital intensive industry.

After experiencing the madness of 2017–2018, the entire Crypto ushered in two years of development and precipitation. The prototypes of various standards and protocol applications such as DeFi and NFT appeared at this time, and they have been dormant until 2020. The unprecedented technological explosion coincided with the easing of the U.S. dollar after the epidemic, which brought an unprecedented amount of funds to the Crypto market and enriched the Crypto application market unprecedentedly. This is also the Crypto industry that most people are familiar with.

At this stage, with the influx of a large number of VC institutions and funds, Crypto VC funds worth billions of dollars have emerged in an endless stream. The number of projects invested and financed, the amount of investment, the scale of investment and the number of institutions have hit a record high. Investing through U.S. dollars and stablecoins has also become the most common way. In the past, the currency-based investment method has become more of a means of ecological support for the L1 chain.

The 10-year history of Crypto development may not be long, but it has also witnessed the entire process of the encryption industry from barrenness to prosperity from another perspective.

Substack today is sponsored by Onomy

Onomy Protocol has now launched mainnet with the token distribution planned for 6th of December, 3PM UTC. Onomy, a Cosmos-based decentralized finance protocol, has raised $10 million in a private token funding round. The round was backed by investors including Bitfinex, GSR, Ava Labs, CMS Holdings and DWF Labs.

The Bitcoin Era (2013–2016)

Before the emergence of Ethereum, there was only one narrative protagonist in the Crypto world — BTC, and there were only three types of narratives surrounding BTC — transaction, payment, and mining. This narrative, which seems a little thin now, was the trend of that era. It supported the establishment and expansion of the early encryption circle, and provided the earliest nourishment and spiritual totem for the later glorious era.

2013

During this period, the policies of various countries have not yet carried out strict supervision, and applications, investment, speculation, etc. are all related to Bitcoin. It can be said that in the Crypto market at this stage, Bitcoin is the core and only narrative. Throughout 2012, the investment and financing of Bitcoin start-ups was only $2.1 million. Even in 2013, there was an investment record of tens of millions of dollars. The financing of more than $5 million was unique at the time. The three investments were in Coinbase, Bitcoin China and Circle respectively.

During this period, the policies of various countries have not yet carried out strict supervision, and applications, investment, speculation, etc. are all related to Bitcoin. It can be said that in the Crypto market at this stage, Bitcoin is the core and only narrative. Throughout 2012, the investment and financing of Bitcoin start-ups was only US$2.1 million. Even in 2013, there was an investment record of tens of millions of dollars. The financing of more than US$5 million was unique at the time. The three investments were in Coinbase, Bitcoin China and Circle respectively.

In 2013, the largest financing went to Coinbase, which is now listed in the United States. The investment institutions behind it include star Andreessen Horowitz (a16z), as well as low-key and precise VCs such as Union Square Ventures and Ribbit Capital. Union Square Ventures is one of the most well-known venture capital institutions in the United States. Its existing investment landscape includes Protocol Labs, Dapper Labs, and star projects such as Arweave, Polygon, and zkSync, as well as well-known encryption-native investment institutions Polychain and Multicoin Capatil Wait. Ribbit Capital, established in 2012, also has industry-leading projects such as Ethereum, AAVE, and Arbitrum in the crypto investment landscape. It is also a very active VC in early industry investment.

In 2013, Bitcoin China was the largest and earliest Bitcoin exchange in China at that time. The US$5 million financing from Lightspeed China may have taken its advantage. Although this investment failed in the end, Bitcoin China carried the memories of the first batch of encrypted OGs in China. Since then, Lightspeed China has never invested in any Crypto projects. Instead, its overseas parent company, Lightspeed Venture Capital, has maintained more than ten investment records in Crypto. The more famous investment projects include Yuga Labs, Magic eden, Zerion and the current The protagonist is FTX, but from the perspective of the number of investments, the Crypto field is obviously not the focus.

Another well-known investment in 2013 was in Circle Internet Financial. At this time, Circle was not the USDC issuer we know now, but a Bitcoin application company. As the founder of the start-up company, Jeremy Allaire positioned the company at the time to build products based on BTC to promote the wider application of BTC, such as using Bitcoin through Skype or email. It was his idea that also led him from Breyer Capital and Accel Capital received $9 million in financing, which was the largest financing in the Bitcoin application track at that time. The USDC issued by Circle did not come out until September 2018.

According to Coindesk, in 2013, various encryption start-ups raised $88 million from VCs, dozens of times more than the previous year, and there were many firsts around Bitcoin in this year, such as : In November, Bitcoin broke through $1,000 for the first time; the first Bitcoin ATM was operated in the Waves coffee shop in Vancouver, and the mining power of Bitcoin jumped from 20Th/s to 9000 Th/s for the first time, etc.

2014

In June of this year, the total amount of investment and financing in the industry has exceeded the sum of 2013, reaching US$314 million for the whole year, an increase of nearly 3.3 times compared to US$93.8 million in 2013.

The most active investment institution this year was called 500 Startups, which was established in 2010. It was one of the four incubators in Silicon Valley supporting the development of Bitcoin application companies at that time, and it was also the largest among the four (the other three were Boost VC, Plug and Play Technology Center and CrossCoin Ventures), after that, 500 Startups gradually developed and became the most active early-stage venture capital institution in the world, spanning various investment fields, but gradually withdrew from the in-depth tracking of the encryption field, and the investment in the Crypto field also Just focus on transactions and payments.

In 2014, the amount of investment in the field of Bitcoin applications was further enlarged. There were 4 investment records exceeding 20 million, including wallet service provider Blockchain’s $30.5 million, BTC payment platform BitPay’s $30 million, and Bitcoin sidechain research agency Blockstream’s $21 million, and $20 million from bitcoin mining equipment provider Bitfury.

The bitcoin payment platform BitPay was one of the representatives of blockchain financial technology at the time. The US$30 million in this round of financing was led by Index Venture, AME Cloud Ventures under the co-founder of Yahoo! Yang Zhiyuan, Li Ka-shing’s private venture capital company Horizons Venture And Felicis Ventures and many other institutions were involved. Most of these investments were very traditional Web2 venture capital. After that, there were not many involved in the Crypto field. And they invested BitPay because it represented the forefront of fintech.

As for Blockstream, it is the largest and the earliest development team to study Lightning Network. As the core narrative of Bitcoin payment, Lightning Network has been the core of Bitcoin ecology since it was proposed, and it was also the most important innovation since Bitcoin was founded. Afterwards, Blockstream launched its own Lightning Network client c-lightning, and also launched the Bitcoin sidechain Liqduid. Although the latter developed slowly, the Lightning Network has steadily moved forward in the turbulent Crypto industry iteration. According to statistics from the 1ML website, as of November 14, the number of bitcoins locked in the Bitcoin Lightning Network has exceeded 5,133, a record high. In addition, the discussion on capacity expansion in the BTC community in 2015 has become increasingly heated. It has successively poured into Lightning Labs, ACINQ, Lightspark and other Lightning Network research institutions, and jointly promoted the further development of Lightning Network.

In 2014, in addition to the above-mentioned companies, OKcoin (now OKX), which was established not long ago, also received $10 million in financing that year. The VCs behind it include Ceyuan, Mandra Capital, VenturesLab, etc. It is worth mentioning that although Ceyuan Venture Capital is a well-known traditional Internet VC institution in China, its co-founder Feng Bo, a Web3ist with a keen sense of smell, established the well-known encryption investment institution Dragonfly Capital in 2018 (Dragonfly Capital), and launched encryption funds of $100 million and $225 million in that year and 2021, respectively. Moreover, in the third round of fundraising this year, another $650 million was raised. Not only was it oversubscribed, but the LP also included the names of the world’s top venture capitalists such as Tiger Global, KKR, Sequoia China, and the Ivy League Endowment Fund.

Of course, these are things to come. If you look at the encryption VC investment throughout 2014, you can sum it up in one word: steady growth.

2015

This year, with the further development of blockchain technology, more and more capital and entrepreneurs have begun to target this emerging field.

Around the bitcoin payment field, more and more application-oriented enterprises focusing on remittance and settlement have sprung up. Although the price of Bitcoin fell from its all-time high in November 2013 to a new low in early 2015, large financings for Bitcoin startups continued. In total, a total of $380 million has been invested in startups in this industry.

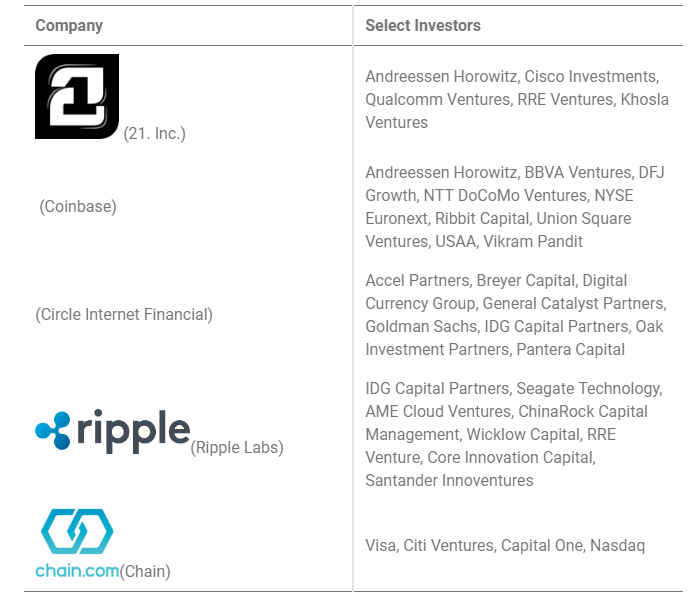

Among them, large-scale financing includes Coinbase’s $75 million Series C financing, Circle’s $50 million Series C financing, BitFury’s $20 million Series B financing, and Chain’s $30 million Series B financing. Chain is a company that provides infrastructure services for Bitcoin applications. At that time, Chain’s Series B financing included Visa, Nasdaq, Citi Ventures, and Capital One (one of the Fortune 500 and one of the US banking giants) and many other well-known strategic investors, but Chain was acquired by Stellar in 2018.

This year, OpenCoin also changed its name to Ripple Labs and completed a $28 million Series A round of financing this year. The Bitcoin start-up company 21 Inc. (formerly 21e6), which set a financing record for the entire industry that year, also announced in March this year that it had raised $116 million in venture capital, with investors including a16z, Qualcomm, Cisco, and Paypal Wait for a star enterprise. Although 21 Inc has a halo of huge financing, neither the subsequent mining hardware products nor applications have caused a sensation, and 21 Inc itself has been forgotten by people in the rapidly changing industry.

Top financing projects in the encryption industry in 2015 (Data source: cbinsights)

This year, OMERS Ventures, which manages municipal pension funds in Ontario, Canada, announced its investment vision in the blockchain field. They stated that they would use the 260 million Canadian dollars they raised to explore investment opportunities in the Bitcoin and encryption fields. Many years later, another Canadian Ontario teacher’s pension fund lost nearly $100 million due to FTX. However, for this industry full of unknowns and opportunities, more and more capital has begun to focus on this field.

In 2015, a number of VC institutions were active in the industry. In addition to a16z, Union Square Ventures, and Ribbit Capital that appeared above, there was also Boost VC, which wanted to invest in 100 Bitcoin startups in two years; the company name was changed from Bitcoin Opportunity Corp was changed to Digital Currency Group (DCG) and successively invested in 35 crypto startups including Coinbase, Circle and Ripple Labs. Later, under the leadership of founder Barry Silbert, DCG gathered media Coindesk, transaction lending and asset custody platform Genesis, mining Foundry and Grayscale, the world’s largest digital currency asset management company, have become one of the largest conglomerates in the Crypto industry.

Looking back at the investment and financing in 2015, the capital market was a different scene in the crypto bear market .

2016

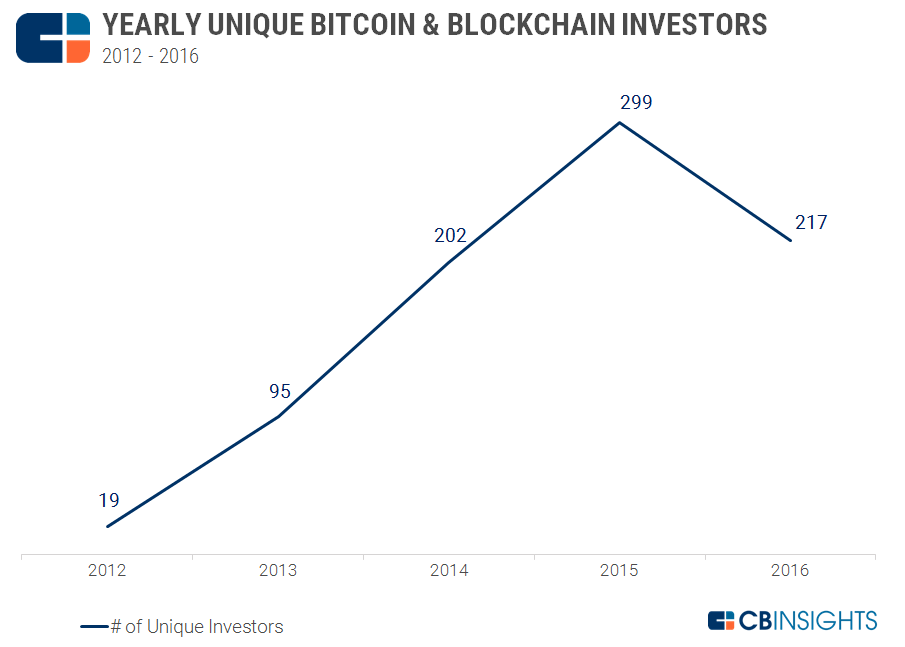

Compared with the continuous growth of the investment and financing market in the past few years, this year, along with the general reduction of external investment and financing in the fintech investment field, the VC investment in the entire encryption market has also entered a decline stage. According to CB Insights, although the investment in Bitcoin and blockchain companies increased from 19 in 2012 to 217 in 2015, with an average annual growth rate of 187%, but in 2016 it decreased by 27% compared with the previous year , fell back to the level of 2014.

2012–2016 Encryption Industry Investment and Financing Transactions

(Data Source: CB Insights)

Judging from the number of investments, it indeed shrunk, but in terms of the total investment amount, Bitcoin and blockchain start-ups received a total of 550 million dollars in investment in 2016, which is still an increase compared to 2015, but a large part of it Part of the funds have been invested in relatively mature companies, and the first four financings accounted for half of the total for the year.

In 2016, there were four investments exceeding US$50 million, namely Circle’s US$60 million D round; Digital Asset Holdings’ US$60 million A round; Ripple’s $55 million B round and Blockstream’s $55 million A round of investment. And these companies basically appear on the investment list every year, which also shows that as companies in the field become more and more mature, related investments have also begun to move steadily to the later stage.

This year, Circle gave up its transaction services for Bitcoin and began to focus on remittance and payment services, avoiding competition with the growing Coinbase, and this change also launched its own stable currency for Circle Foundation. Also this year, Carlson-Wee, the first employee who left Coinbase, founded his own hedge fund, Polychain Capital, as a native encryption fund. At that time, the Polychain Capital fund was supported by a16z, Union Square Ventures and Sequoia Capital, and this year Earlier this year, Carlson-Wee raised $750 million for his third venture fund, led by Tiger Global Managpent and Singapore’s Temasek.

At the same time, in 2016, start-up projects financing through ICO began to grow slowly, including the well-known The DAO project raised 150 million US dollars, but the real ICO boom has not yet come.

Carnival and Dormancy (2017–2019)

2017

2017 is a year where madness and supervision intersect, carnival and loneliness coexist.

This year, Ethereum set off an ICO craze for cryptocurrency by virtue of the ERC-20 protocol standard. Immediately after the implementation of the 9.4 regulations, the market quickly turned cold after a brief rebound, followed by a long bear market that lasted for more than two years. In this year’s ups and downs, how did VC perform compared to ICO?

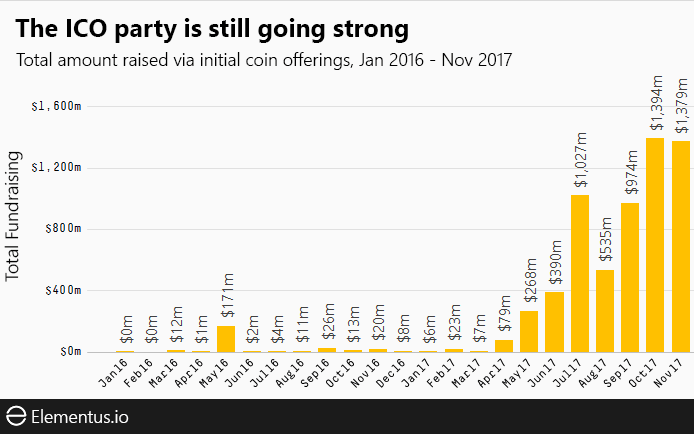

According to CB Insights statistics, in the first quarter of 2017 alone, 19 ICO projects raised $21 million, and in the fourth quarter, more than 500 ICO projects raised nearly $3 billion. Throughout 2017, the total amount of VC investment was 1 billion US dollars (215 transactions). Although it once again set a new record for the total amount of VC investment, compared with the new financing method of ICO; in 2017, nearly 800 projects raised as much as 5 billion dollars of funds, that is to say, the market’s investment in ICO is five times that of VC’s investment in blockchain start-ups. It can be said that the emergence of ICO has squeezed the VC market to a certain extent.

There were many large-scale ICO projects back then, such as:

● Filecoin raised $257 million;

● Tezos raised $232 million;

● Bancor raised $152.3 million;

● Polkadot raised $140 million;

● Quoine raised $105 million

2016–2017 ICO financing statistics (Data source: Elementus.io)

Of course, in this round of carnival, not only ordinary investors participated in the ICO, but some institutions also participated directly. With ICO, they can reap returns within months or even days, which was very attractive for any capital, such as: decentralized network developer Blockstack in its ICO offering, well-known investors such as Union Square Ventures (USV), Foundation Capital, Lux Capital, Blockchain Capital, and DCG participated.

Where did all these huge funds go? According to the analysis of the venture capital firm Atomico, more than 40% of ICOs were initiated in the European Union (EU) in 2017, with 446 ICO records and a total of $1.76 billion raised, accounting for nearly 40% of the total global ICO, the second largest The capital flows to North America, with a total of 1.076 billion US dollars of ICO funds flowing to project parties in this region. After the ban, many encrypted VC institutions in China either chose to withdraw, or moved to Hong Kong, Singapore and other places to conduct business, and the participation of domestic capital in encrypted native projects has decreased significantly.

On the other hand, the aggressive financing method of ICO was destined to fall into an unsustainable situation after the market turns bearish and risks were exposed. Moreover, in many places around the world, ICOs were suspected of bypassing existing regulations to raise funds. Moreover, many projects themselves did not have reliable products and business models, and some projects have even switched to VC after financing. Therefore, under the pressure of the 9·4landing and global regulation, the ICO bubble also burst.

2018

The inertia of ICOs continued into 2018.

In 2018 Q1, there were still more than 400 financing projects completed through ICO, and the amount was as high as 3.3 billion US dollars. According to CoinSchedule, there were 1,253 ICO projects worldwide in 2018, raising more than 7.8 billion dollars in funds that surpassed the record high set in 2017. While ICO brought financial carnival, it also brought great financial risks. It was also at this stage that a group of early investors completed the original capital accumulation. Afterwards, with the plunge of Bitcoin, the entire market entered a cold winter period. Many ICO projects failed to survive to the moment of market recovery. At the same time, many investors lost their money.

The largest projects are as follows:

● EOS: EOS raised the highest amount of funding ever in its ICO, over $4 billion.

● Telegram: It raised nearly $1.7 billion in two rounds of ICO and wanted to build a blockchain network called Telegram Open Network (TON), but then the project was abandoned and taken over by the TON Foundation, “Telegram Open Network” was also renamed “The Open Network”, and now, more people know that it comes from related advertisements pushed by Telegram.

● Petro: This is the cryptocurrency officially backed by the Venezuelan government. In August 2018, they raised almost $740 million in an attempt to circumvent economic sanctions by creating their own cryptocurrency and using it as a payment method for oil. Apparently, they failed. .

● Basis: The algorithmic stablecoin Basis raised 130 million US dollars through ICO this year. Although it performed well in the calculation boom in 2021, the whole track is only a flash in the pan. However, from the perspective of market demand, the algorithm The field of stable currency still has a good application prospect.

In terms of VC equity financing, the two largest financings in 2018 came from Bitmain. In June 2018, it received $400 million in Series B financing from Red Shirt Capital. Two months later, it again received Tencent, Softbank and For CICC’s $1 billion Pre-IPO investment, VC investment and financing amounted to $4.26 billion for the whole year. Although it was not as large as ICO funds, it was still in the growth stage.

In April of this year, Coinbase, which has been established for many years, officially launched its own investment department — Coinbase Ventures. At the same time, Coinbase co-founder Fred Ehrsam also left Coinbase this year, and cooperated with former Sequoia Capital partner Matt Huang to establish the well-known Encryption investment institution-Paradigm; A16z also raised 300 million US dollars for its exclusive Crypto fund (a16z Crypto Investments), and began to enter the encryption industry on a large scale, and appeared in the investment background of many star projects, and invested in CryptoKitties, Dfinity, Earnin and other projects that year; Fidelity also launched its own cryptocurrency institutional platform this year.

It was also at this stage that various “blockchain +” explorations and applications were born. Although many of them may only be in the concept stage, it was precisely in this round of upsurge that many valuable innovations have been precipitated. technology and application, and provide basic nourishment for the future “Blockchain Cambrian Species Explosion”.

2019

According to CB insights, the number of global blockchain investment and financing transactions in 2019 was 806, which has changed little compared to 822 transactions in 2018; however, the scale of investment and financing has declined. Compared with the $4.26 billion in 2018, it dropped by 27.9%. This was also the first decline in the amount of investment and financing in the industry since 2013.

In addition, in terms of investment frequency, according to Zeroone Finance statistics, the most active blockchain investment institution in 2019 was still Digital Currency Group, with 14 investment and M&A events. Followed by Collins Capital, Coinbase Ventures, Fenbushi Capital, etc., each with more than 10 investment events.

2017–2019 Industry Investment and Financing Statistics

(Data Source: Huobi Research Institute)

From the perspective of segmented tracks, investment institutions in 2019 were involved in digital currency exchanges, games, digital currency wallets, digital asset management, smart contracts, DeFi, etc., but the most concentrated was still the trading platform.

This year, Animoca Brands, a Hong Kong mobile game developer listed on the Australian Stock Exchange, quickly established its first-mover advantage in the field of blockchain games through investment and mergers, and can be seen in many P2E concept games after that. Animoca Brands, and it itself has become a well-known investment institution in the Crypto field from a game developer; in May of the same year, FTX was established, and at this time Alameda Research was already the largest liquidity provider and partner in the cryptocurrency market. As one of the market makers, FTX has liquidity support from Alameda Research as soon as it goes online. To a certain extent, Alameda has made FTX a success, and the subsequent development proves this sentence: success is also Alameda, and failure is also Alameda.

Throughout 2019, the enthusiasm for investment in the global blockchain field has dropped significantly. Not only have traditional institutions become more cautious, but some emerging institutions have also significantly shrunk their front lines. The performance of institutions in this bear market may give us some inspiration. Now we are in a new round of bear market, but judging from the investment market, whether it is investment enthusiasm or the number of institutional sales, it seems that there are no signs similar to those in 2019.

Recovery and Upsurge (2020–2021)

2020

This year, DeFi began to emerge and attracted the most attention.

According to PADate, the total investment and financing of the encryption industry in 2020 was approximately $3.566 billion, which was basically the same as in 2019. Among them, the DeFi field took US$280 million, accounting for about 7.8% of the whole year. Although the amount was not large, the number of financing in DeFi was also the largest. Among the 407 projects that disclosed financing information, more than a quarter are DeFi projects, but these showed that more and more capital was beginning to try this new type of Crypto native project.

The current common DeFi applications have also won the favor of a lot of capital this year, such as: Unswap completed the A round of 11 million dollars, 1inch completed the seed round of 2.8 million dollars, and the lending platform AAVE completed the 25 million dollars A round and so on. Throughout 2020, the scale of DeFi lockups has increased by nearly 2100% throughout the year, and independent addresses have also increased by 10 times. Compared with the data one year later, these may not be worth mentioning, but the tide of DeFi summer has already form.

Among some well-known investment institutions, native blockchain VCs were obviously more inclined to industry application projects, especially DeFi projects. Focusing on the most cutting-edge fields, the method was more radical and the risk is greater. And investment institutions with different backgrounds have different investment logic and investment preferences, which were directly related to their cultural attributes.

According to PADate, more than 700 institutions and individuals have participated in blockchain project investment throughout 2020. Among them, NGC Ventures was the most frequent investor. Then there were Coinbase Ventures, which has been established for nearly two years, and Alameda Research, which is now in deep trouble.

2021

With the development of blockchain technology, more and more venture capital institutions around the world regard this technology as the key to the future, especially under the impact of concepts such as Metaverse and Web3, which have promoted human The most significant shift — a shift to a new way of thinking, a new mindset and way of thinking, has seen numerous agencies, businesses, and brands embrace the industry.

In 2021, about $33 billion flowed to blockchain startups, which was the highest value ever, while in 2012 this value was only $2.1 million. In less than ten years, the investment and financing value of the encryption industry has increased Hundreds of thousands of times, according to PwC’s statistics, the average project financing amount in the encryption industry in 2021 will also reach an astonishing $26.3 million.

In addition, 2021 was also the year with the largest number of blockchain venture capital transactions, with more than 2,000 investment and financing transactions, twice that of 2020. Moreover, with the increase in the frequency of late-stage financing, 65 startups with a valuation of $1 billion have emerged in the industry, which also reflects the overall change of the Crypto market from niche to mainstream.

According to Galaxy statistics, there were nearly 500 global blockchain venture capital institutions in 2021, and the number and scale of funds have set a historical record. In addition, leading global institutions and companies such as Morgan Stanley, Tiger, Sequoia Capital, Samsung, Goldman Sachs KL Bank have also entered the blockchain market through late-stage equity, and the entire Crytpo market was full of hot money.

2021 was also the year with the largest influx of new users. According to Gemini research, nearly half of the users in several major cryptocurrency application regions around the world just started investing in cryptocurrency for the first time in 2021. The number of new users in the United States accounts for 44% of the total number of users in the country, 46% of new users in Latin America, 45% in the Asia-Pacific region and 40% in Europe. The influx of a large number of new users was the innovation and development of Crypto applications while development provides the most solid user base.

In July of this year, FTX announced the completion of a US$900 million Series B round of financing at a valuation of US$18 billion. This round of financing became the largest private equity financing in the history of the encryption industry, attracting as many as SoftBank Group, Sequoia Capital and Lightspeed Venture Capital. 60 investment institutions participated, and this may also be the largest investment loss of these institutions in the encryption industry.

The most active blockchain investment institution in 2021 is Coinbase Ventures. In April of the same year, it completed its listing in the United States and became the first listed cryptocurrency exchange. In the first year of listing, it invested heavily in 68 blockchain companies. chain startups. Before listing, Coinbase has raised a total of nearly $547 million in more than 13 rounds of financing. If we compare it with FTX, which raised $900 million later, we can get a glimpse of the vision of various capital institutions for the listing of FTX. Besides Coinbase Ventures, the most active investors are China-based AU21 Capital and a16z, which invested in 51 and 48 companies respectively during the year.

From a geographical perspective, the total financing amount of blockchain companies in the United States was still the largest in 2021, reaching 14.1 billion US dollars, accounting for nearly half of the global financing amount. According to the application field, NFT startups have the largest growth rate, and their venture capital has jumped from 37 million US dollars in 2020 to 4.8 billion US dollars in 2021, an increase of more than 100 times, becoming another core application track after DeFi .

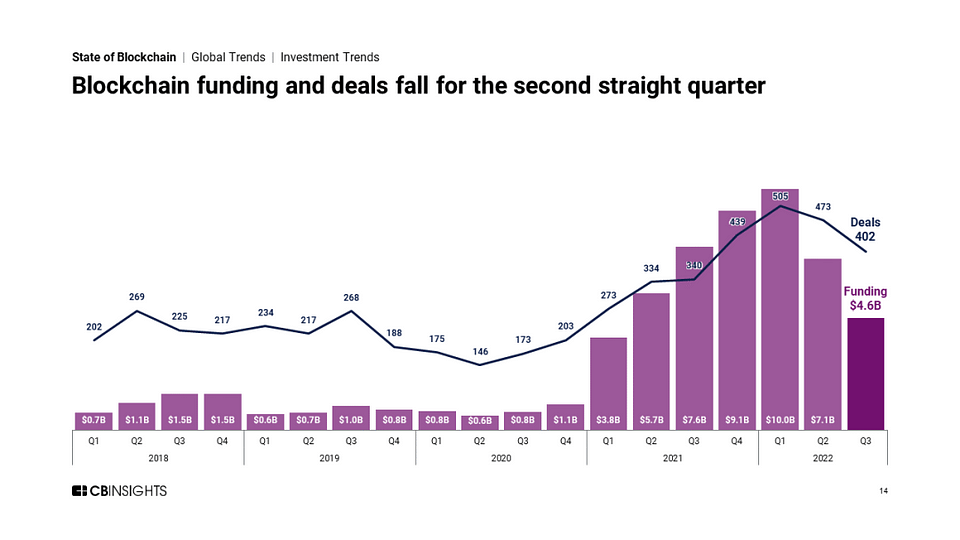

Cold winter? Dormant again? (2022-)

According to the statistics of CB Insight, the cumulative investment and financing amount of the blockchain industry in Q1 this year reached 10 billion dollars, and the number of investments was as high as 505, which also hit the highest in history. Although there was a continuous decline in Q2 and Q3, but it is still possible to break the record of last year’s investment and financing. However, the emergence of a downward trend shows that the collective front of encryption capital has shrunk. This is not only due to the industry itself entering and the bear market cycle, but also the impact of external US dollar interest rate hikes and black swan events such as Luna and Three Arrows.

2018–2022Q3 blockchain industry financing situation (Data source: CB insight)

Accoriding to the data of the third quarter, Coinbase continued to top the list of the most active investment institutions, investing in 23 start-up companies. Animoca Brands and a16z, as investment institutions that have been very active in history, also reduced their investment in this quarter. Investment in the blockchain industry.

Sort out several billion-level financing in 2022:

● Epic Games, April: $2 billion in financing

● European encryption broker Trade Republic, June: $1.15 billion in financing

● Robinhood, May: $600 million in funding

● Encryption infrastructure Fireblocks, April: $550 million in financing

● Copper, April: $500 million in funding

● April, Consensys: $450M in funding

● February, Polygon: $450M in funding in 2022

● Yuga Labs, March: $450 million in funding

● FTX, January: $400 million raised

● Circle, April: $400 million in funding

● NEAR, April: $350M in funding

● Dapper Labs, March: $250 million in funding

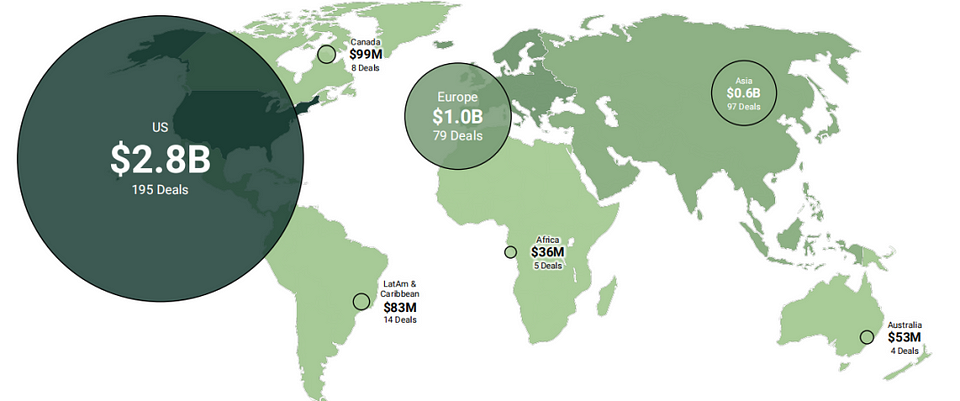

We can find that most of them happened before the Luna incident in May, and the regions were basically concentrated in the United States and Europe. In Q3, nearly half of the global blockchain investment project financing flowed to American companies, and the United States raised $2.8 billion in financing that leads the world, followed by Europe with $1 billion. In September, the White House released a cryptocurrency regulatory framework, which was welcomed by many encryption companies. This also shows that the current Crytpo innovation and capital center is mainly In the United States. In Asia, industry financing dropped from $1.5 billion in the previous quarter to $600 million in the third quarter, mainly in Singapore and South Korea.

Global blockchain financing map in Q3 2022 (Source: CB insight)

A recent JPMorgan research report shows that as the bear market continues, the current pace of capital flows in the encryption industry has slowed to less than one-third of 2021 levels, and this trend will continue for some time . Capital shrinkage is a fact, and the next year may usher in a situation similar to 2019. The market is depressed, capital is conservative, and users are lost. Project parties will have to operate carefully with existing resources. Especially for project parties that have obtained financing during 2021–2022, how they survive the next few years and survive until the next round of bull market will determine whether they have the opportunity to grow into new unicorns in the future.

Summary

1. From the application of Bitcoin ten years ago to blockchain innovation enterprises, and then to the encryption or crytpo industry, this change in the name of the industry actually reflects the development and changes of the entire industry, which is highly consistent with the focus of the market , that is, from the rise of Bitcoin to the widespread mention of the blockchain, and then to the birth of the encryption industry or various applications of Crypto.

2. “Easy to start, hard to survive” is a typical feature of Crypto companies. According to CB Insights tracking research, most blockchain start-ups often die because they cannot raise funds in the second round of financing after completing the first round of financing.

3. In terms of investment rounds, traditional institutions tend to prefer the growth and maturity stages, while crypto-native capital prefers the start-up stage.

4. Before 2017, seed rounds and angel rounds were the most popular investment stages for investment institutions. After 2017, a large part of capital prefers to invest in round A or later. The shift of investment rounds also means that capital is not only focused on The innovation of blockchain projects has also gradually paid attention to the industrial aggregation of blockchain, which also shows the increase of investment targets and the gradual maturity of the application market.

5. The United States has always been the core area where blockchain investment and financing events take place, and this concentration continues to increase.

Compared with the rapid bull-bear transition of the entire industry, there seems to be a hysteresis effect in the primary investment and financing market. For example, in bear market years such as 2015, 2018, and 2022, capital is still investing on a large scale, while in 2016 Years such as 2020 and 2020, when the bull market was beginning to appear, have maintained the prudence during the bear market. This is not a matter of the vision of the institution, but the stickiness of the institution itself to respond due to operations and so on.

In the 10-ear development process of the encryption industry, the development of encryption venture capital capital has witnessed the process of the entire industry from 0 to 100, and it has also boosted the industry’s progress. We don’t know what the next round of encryption industry will be. The time is blowing again, but it is foreseeable that the future encryption venture capital and industry ecology will continue to grow and grow.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish