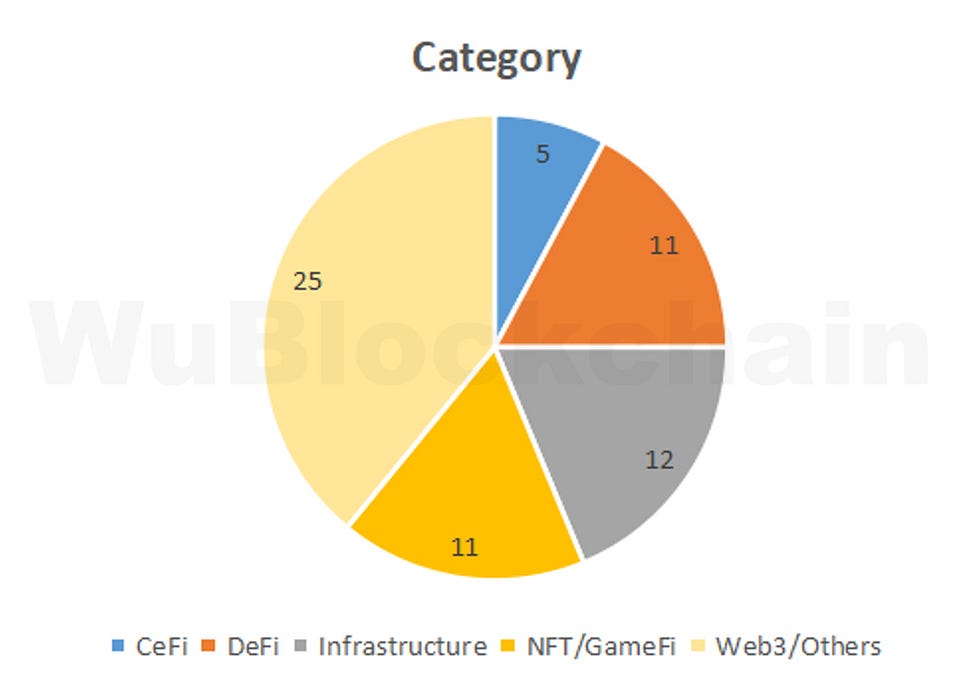

According to the statistics of Messari, there were a total of 65 open investment projects of crypto VC in November, down 9% MoM (71 projects in October 2022) and 55% YoY (143 projects in November 2021). The industry classification is as follows:

In November, the number of track financing in the crypto market remained roughly unchanged, among which the infrastructure field accounted for about 38%, accounting for the largest proportion. CeFi, DeFi, Infrastructure and NFT/GameFi accounted for about 7.7%, 16.9%, 18.5% and 16.9%, respectively.

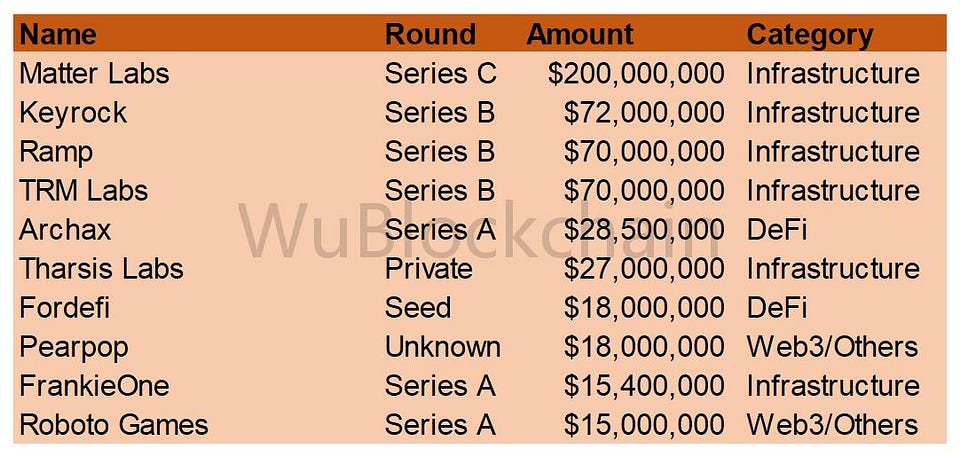

Total financing in November was $840 million, down 1% MoM ($850 million in October 2022) and down 84% YoY ($5.25 billion in November 2021). Both the number of funds raised and the amount raised in November were the lowest in nearly two years. The top 10 rounds by financing amount (excluding CeFi) are as follows:

Matter Labs, the team behind zkSync, raised $200 million in a funding round led by Blockchain Capital and Dragonfly, Variant, a16z, and LightSpeed Venture Partners followed. The team expects zkSync to be online by the end of this year or early 2023.

Keyrock is a crypto market maker that provides its market-making advice to clients for a flat monthly fee, in addition to earning revenue from trading spreads. Details of the financing, led by Ripple, were not disclosed.

Ramp, a crypto payments company, raised $70 million, led by Mudabala Capital and Korelya Capital, at a valuation of more than $450 million. Ramp’s core product is its software development kit, which allows users to buy cryptocurrencies with debit and credit cards, bank transfers and Apple Pay.

Blockchain analytics firm TRM Labs raised $70 million in a funding round led by Thoma Bravo, a private equity firm with $122 billion in assets under management, with Goldman Sachs, PayPal Ventures and others. The money will be used for product development and hiring. TRM Labs previously raised $60 million in Series B funding.

Crypto exchange Archax has raised $28.5 million in a round led by Abrdn with Tezos Foundation and others. Archax is the only crypto exchange licensed by the Financial Conduct Authority in the UK and is currently launching a range of regulated trading products.

Tharsis Labs, the core development team behind Evmos, raised $27 million in a Token Sale led by Polychain Capital, which included Galaxy Digital, Huobi, and others. Funds will be used to hire more engineers, develop strategic partnerships, and build an Evmos ecosystem of interoperable, decentralized applications. Evmos is an EVM compatibility chain built using the Cosmos SDK that makes it easy for developers to launch Dapps for use across ecosystems.

Wallet Fordefi closed an $18 million seed round led by Lightspeed Venture Partners, with contributions from Electric Capital, Alameda Research, JumpCrypto and others. Fordefi’s MPC Wallet platform and Web3 gateway enable agencies to seamlessly connect to Dapps through various chains, providing MPC key management, self-service DeFi policy control, trade time smart contract insight, trade simulation and risk alerts.

Pearpop, a blockchain creator collaboration platform, was funded by Hollywood star Ashton Kutcher, Avalanche’s Blizzard Fund and C2 Ventures. To date, the company has been valued at $300 million and raised more than $34 million in total funding.

FrankieOne, which provides an API platform for identity verification and fraud detection, raised $5.4 million, bringing its Series A funding total to $30 million. New strategic investors include Binance Labs and Kraken Ventures.

Roboto Games, a game studio, was led by a16z and led by Animoca Brands. Roboto Games expects to launch an initial playable version of its MMO called Foragers and Fighters in the first quarter of 2023.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish