After receiving over $14 million in funding from Paradigm and other institutions, Blur, a self-described NFT trading marketplace “for professional traders”, has been on a roll recently. NFTScan shows that as of December 16, Blur’s NFT trading volume in the past month is second only to Opensea, accounting for about 29% of the entire NFT market share (chart below), leaping to become the largest NFT aggregated trading marketplace on the chain, giving OpenSea unprecedented pressure.

As a clear-cut airdrop, the official statement previously said that the BLUR Token will be online next year, but this is still based on the total amount, Token allocation and other Tokenomics have not yet been clarified. The bonus hunter is actually in a passive state with the risk of being back jacked, but this has not affected the enthusiasm of the wool party. This enthusiasm may be related to the wave of air drop FOMO caused by the enrichment effect of OP and APTOS, and the fact that Opensea, the “unicorn” in the NFT market, has been slow to release Token.

The first phase of the airdrop BLUR, which you can get if you have a transaction record in the first 6 months in NFT trading markets such as Opensea, LooksRare, X2Y2, etc., appeared as a consolation prize and the new form of airdrop “open blind box” promotion attracted the attention of the bonus hunter. However, in subsequent airdrop promotions, Blur has twice brought out the “next round is bigger” rhetoric Pick-Up Artist community. Nevertheless, the anticipation of Blur’s ongoing third round of airdrops, and the official tweet that “the third round is the largest in terms of rewards as the last round” still contributed to a surge in Blur’s usage, especially as the whales nearly dominated the charts, and briefly drove a number of blue-chip NFT projects such as BAYC and Azuki up in both trading volume and floor prices.

Blur attracts traders with its “custom royalty + zero fee + airdrop expectations” model

Royalties have long been a sensitive topic in the NFT trading market, where “traders want to maximize profits, collectors want to support creators, and creators want to earn more royalty income”. Because royalties are not enforceable on multiple markets, they vary from platform to platform, with Blur defaulting to the highest royalties in OpenSea, LooksRare and X2Y2. When traders list on Blur, they can customize the royalties for their listings. However, SudoSwap’s zero royalties and X2Y2’s custom royalties respectively have already caused a lot of debate in the market, as the market believes that custom or zero royalties deprive project owners of some of their funds for continued development, so Blur expects to encourage prospective traders to use royalties through the airdrop incentive. In the second round of airdrops, the higher Blur’s user royalty is set, the higher the loyalty will be and thus the more airdrops will be awarded, while for zero-royalty platform users like Sudoswap to migrate the incentive, traders who pay royalties will instead list on Blur and set the royalty to Sudoswap’s platform fee (0.5%) to earn as much profit and receive more airdrops than they would otherwise.

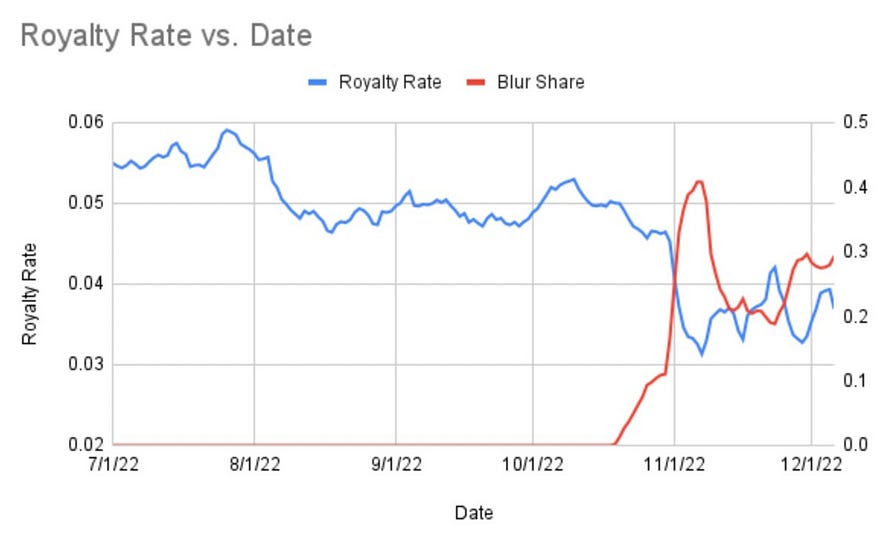

However, according to Proof Research Director NFTstatistics.eth, this expected incentive has not actually prevented low or even zero royalty behavior, with Blur’s overall average royalty rate being just 0.65% (below) and driving down overall NFT market royalties (below).

Blur does not charge users fees like OpenSea, LooksRare and X2Y2. There is no cost for traders to use Blur aggregators, trading markets and other features. With zero royalties, traders can get full revenue directly, but for now zero fees should be used as a short-term strategy to attract new users to use it.

Blur’s profit model has not yet been determined, and current development relies solely on financing

As for how long the “custom royalty, zero fee” model will last, Blur official says they will wait for the Token to go live before voting on the specific royalty and fee plan through community governance and discussion, and Blur will not make a penny until then. Regardless of the final plan, it is foreseeable that Blur will eventually be caught in the “in-roll” battle over royalties and fees commonly encountered in the NFT marketplace. On the other hand, with no profit model and no revenue distribution, the value of BLUR Token is practically zero; if it exists only as a governance Token, it is not only inconsistent with the positioning of a platform Token, but also faces the possibility of being imitated and defeated by other latecomers.

Match the experience of a professional deal, but not as a moat

In terms of experience, Blur is officially claimed to be 10 times faster than Gem, the aggregator acquired by OpenSea. In practice, Blur runs fast and smoothly, but when buying in bulk, it costs more in Gas than other NFT marketplaces. In the case of Element, for example, the Gas cost of buying one NFT at a time is equal to the Gas cost of buying a bulk NFT at a time, while Blur consumes more Gas the more NFTs are bought in bulk, which is probably why Blur almost never fails to buy NFTs in bulk.

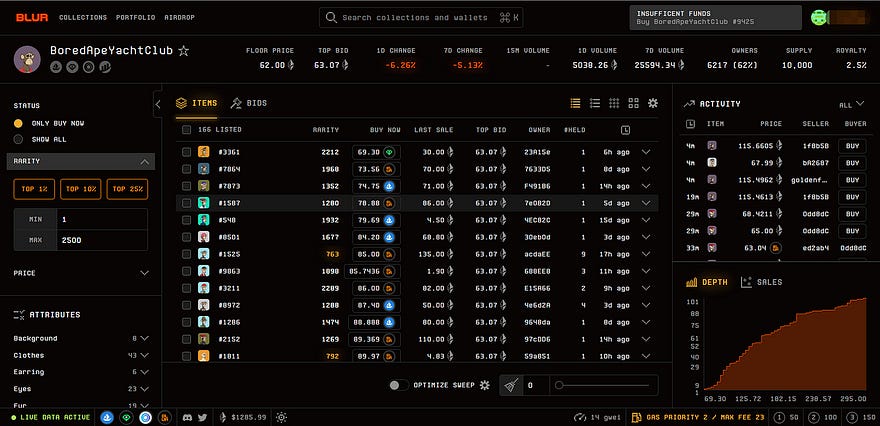

In terms of UI/UX, Blur matches the habits of professional NFT traders. Take BAYC as an example, Blur homepage not only displays price, shelf time, last sale price, but also directly displays different NFT rarity, users can directly select the NFT rarity (1%, 10%, 25%) or price range to browse, the right side of the screen displays real-time NFT sales purchase and shelf time information, the bottom right will display the NFT price depth range of the item. When tapping into a specific NFT, Blur will display the specific features of that NFT, with a sidebar that gives the last sale time, floor price, and volume percentage of each feature, allowing traders to judge the rarity of that NFT for themselves.

Blur provides professional tools, good UI/UX and other supporting functions for traders, but it is important to realize that these supporting tools do not have a monopoly and are highly imitable. Until now, Blur has not had a deep enough “moat” to ensure that it will not be beaten by subsequent challengers. With the brand effect of Opensea’s first-mover advantage having formed strong enough user stickiness, the average user of the NFT trading market is more concerned with the depth and liquidity of transactions and whether the transaction costs are low enough, while the consideration of whether the platform is functional or not is lagging behind these two.

On the whole, Blur is attracting market attention mainly because of the medium-term airdrop expectation, whether it can form long-term user stickiness remains to be seen, especially after the airdrop landing that is the real test.

Reference Article:

https://mirror.xyz/blurdao.eth/2nba-2j0zHPrBX0iPSNGquZ9s_WotNH6B4e5usz85mM

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish