With the long-awaited definitive launch of the BLUR Token approaching, the early announcement of the launch of the BLUR Token by major exchanges as a warm-up and a more relaxed external market environment driving the inflow of funds into the NFT market, the past month has seen a long-awaited rebound in NFT market trading volume and a renewed activity in NFTFI, with the NFT marketplaces with real returns and lending platforms have seen a significant rise in Token. However, prosperity comes with worries, some investors believe that the competition in the marketplace is far from over. After the launch of Token, Blur will certainly adjust the zero-fee model to achieve Token value capture, then it is likely that there will be new imitators on Blur’s way to divide the NFT marketplace share, then the market will face a continuous increase in the state of the involution.

The main contribution to the NFT marketplace comes from the blue chip NFT listing order trading that is spot, for blue chip NFT trading liquidity competition is one of the important objects of the NFT marketplace involution. However, blue-chip NFT floor price is too high, the average retail investor is often difficult to participate with the complexity and skillful trading strategies as large investors or giant whales. Thus, based on the experience of CEX futures volume is much higher than the spot volume, NFTFI consciously go in the direction of derivatives to help retail investors participate in blue-chip NFT trading through leveraged instruments to contribute more volume.

This article will focus on the NFTFI derivatives program to help users identify derivatives track opportunities earlier.

Note: The NFTFI derivatives track is still in its early days with considerable uncertainty. This article is for information sharing only and does not endorse any of the projects described and has no interest in them.

Futures

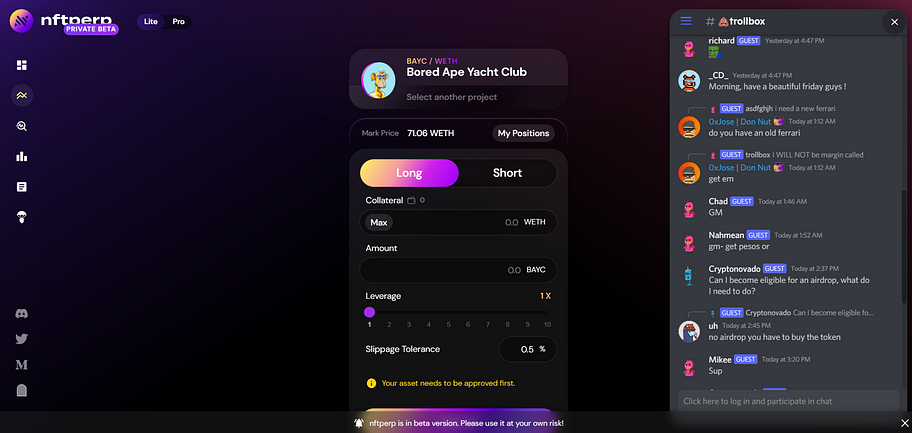

nftperp(https://nftperp.xyz/)

nftperp is a decentralized exchange for NFT perpetual contracts built on Arbitrum, the most mature and well-regarded NFT futures exchange today. Users can trade long or short using ETH as the currency denominator and using leverage (leverage capped at 10x). Currently in private beta, nftperp is open for futures trading on five NFTs: Azuki, BAYC, MAYC, Milady, and CryptoPunks. nftperp uses the original vAMM (Virtual Automated Market Maker) mechanism to maintain liquidity in NFT futures trading, as well as the NFT price evaluation protocol Upshot integrated with the Chainlink prophecy machine data on top of the floor price to further ensure the authenticity and timeliness of the floor price. The platform uses the Keeper bots liquidation mechanism, in which the platform will earn 1.25% of the notional position size when liquidated. In addition to the basic trading functions provided to users, nftperp also provides similar FT trading K-line charts, chat rooms and other features to assist users in trading.

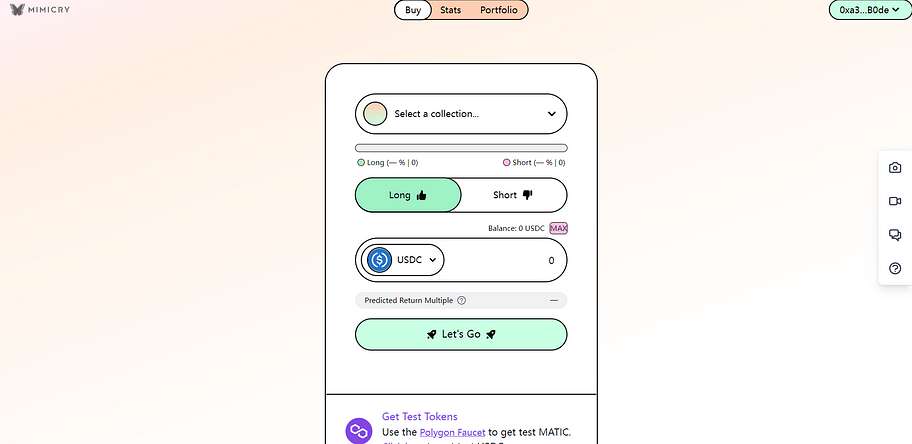

Mimicry(https://www.mimicry.org/)

The Mimicry Protocol is an NFT futures marketplace built on Polygon that uses the Chainlink prophecy machine for price updates. Currently Mimicry is still in beta and users can long or short on World of Women using USDC or LINK as the counterparties, but cannot add leverage for now. In the future, in addition to USDC and LINK, it may be expanded to open positions using WETH, BNB, MATIC, APE, USDT, DAI, etc.

Tribe3(https://testnet.tribe3.xyz/)

Tribe3 calls itself the first gamified NFT futures exchange, built on Ethereum, and supports Azuki, BAYC, CryptoPunks, Meebits, Doodles, Clone X, and Moonbirds in the current beta phase. Users can start trading by depositing ETH with a maximum leverage of five times. When a user’s position is collateralized by less than 10%, it is liquidated. Users who trade are equivalent to fighting NFT tribal battles with other trading users and can earn points and items in competition to create personalized NFT avatars. Tribe3 is currently holding a trading competition in the beta network.

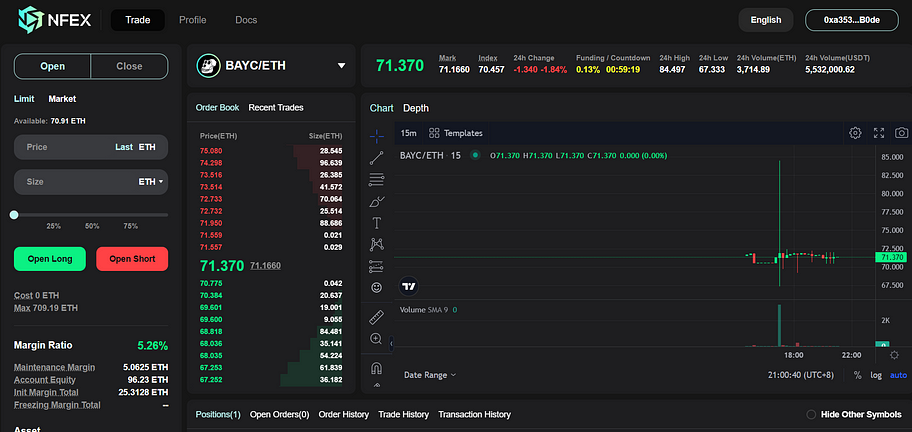

NFEX(https://www.nfex.io/)

NFEX is an NFT derivatives protocol built on Ethereum that allows users to long or short the NFT floor price with up to 10x leverage. Currently in invite-only beta, NFEX supports futures trading on five NFTs — BAYC, MAYC, Azuki, CryptoPunks and Clone X — all with a 2% maintenance margin, and its trading prices are derived from its unique NFEXP indexes — from Blur, OpenSea, LooksRare and X2Y2 are calculated as a weighted average of their respective floor prices. NFEX charges a 0.25% trading fee and is enhancing trading activity by providing incentives to market makers to pay back 0.05% of their fees to achieve better depth.

Options

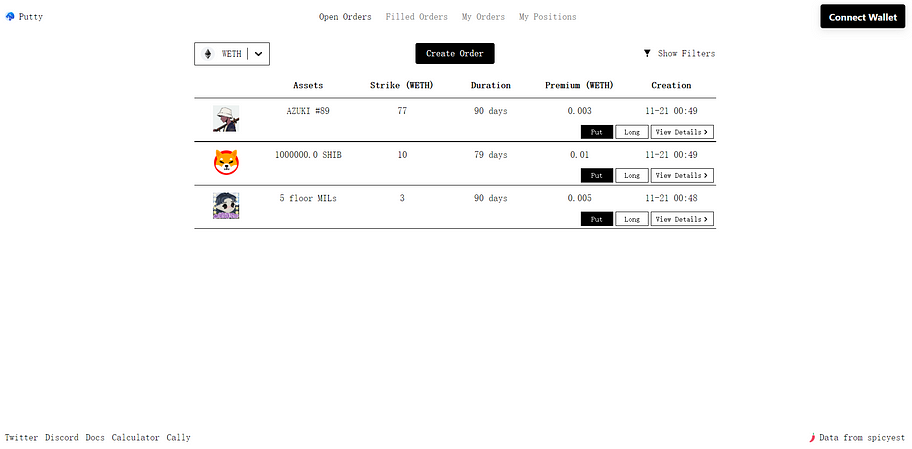

Putty(https://www.putty.finance/)

Putty is a peer-to-peer NFT (ERC 721) and Token (ETH or ERC 20) options marketplace built on Ethereum that allows users to create buy or sell limit orders for put and call options on a single asset (the floor price of a particular NFT series or a single NFT within a particular NFT series) or a basket of assets. A user’s position is itself an NFT: OPUT, so it can be used to transfer between user wallets. Users can create option limit orders using three assets: WETH, DAI, and wsETH. In addition to blue chip NFTs such as BAYC, MAYC, Azuki, etc., a total of 18 NFTs are currently supported, including Art Gobblers, The Saudis, Otherdeed, ENS, etc. Tokens include UNI, SHIB, WBTC, WETH, DAI and the NFT liquidity Token of the NFTX protocol. Dune Analytics shows Putty completed a total of $22.1k in options volume, with Azuki 89, SHIB and MILS options limit orders currently available in the market.

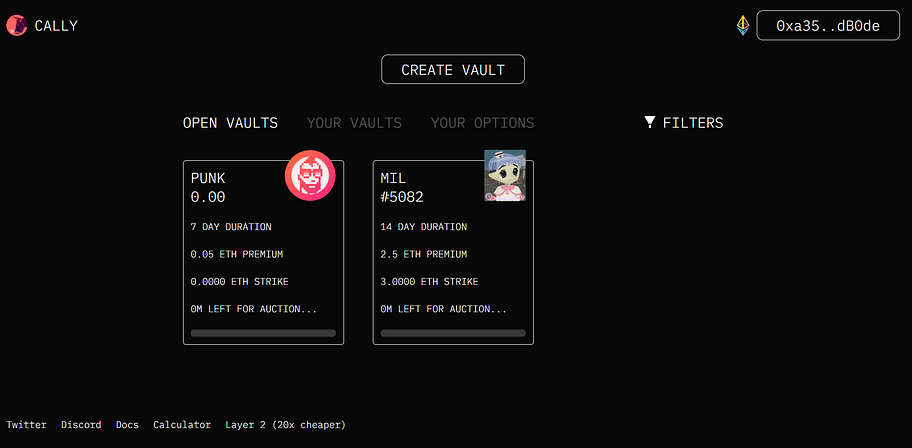

Cally(https://www.putty.finance/)

Cally is a protocol built on Ethereum and Optimism that creates a Covered Call Vault for the NFT or ERC 20 Token held by the user.

Covered Call = Long Stock + Sell OTM Call, i.e. the user holds an NFT/ERC 20 Token and sells the corresponding call option.

Users can create Covered Call Vaults for their NFT or xNFT Token holdings (such as the liquid ERC20 Token applied to the NFT liquidity protocol NFTX), which currently include BAYC, MAYC, Doodles, Milady maker, and Forgotten Runes Wizard’s Cult and the liquidity Token created by these NFTs on NFTX Protocol. Users can choose from cycle yields of 0.05–2.5 ETH, cycle durations of 7/14/30/90 days, and auction starting and floor prices. Once the Call Vault is created, the call option is listed and a 24-hour Dutch auction begins, with the strike price dropping until an interested option buyer appears. With Cally, it helps users who have been bullish on a collection for a long time, but don’t think it will rise in the short run, to earn a profit on the option premium.

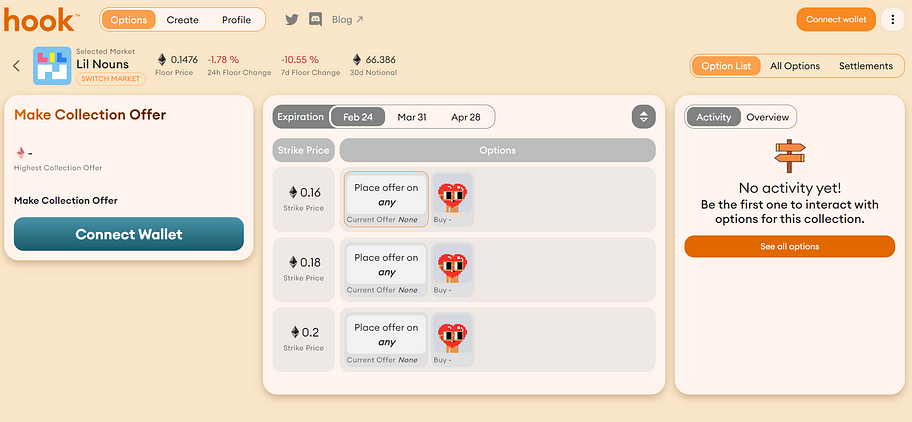

Hook Protocol(https://www.hook.xyz/)

Hook is an NFT European call option protocol built on Ethereum with a mix of cash and physical settlement. It currently offers 11 NFT options such as Lil Nouns, Otherdeeds, Chromie Squiggle, MAYC, Friendship Bracelets and more, of which the MAYC options market has completed 40.864k ETH notional volume in the last 30 days.

Hook settles options by starting an auction of the underlying NFT asset the day before the option expires, and if a bidder bids more than the strike price in the settlement auction, the NFT is sold. The option seller is in effect similar to a physical settlement, receiving the strike price; the option holder is similar to a cash settlement, receiving the difference between the bid and the strike price. In addition, the option holder only needs to bid in the settlement option to complete physical delivery of the NFT, and receives a refund of any bid amount above the exercise price after the option closes.

Hook charges a 10% fee on the sale of options, which is currently audited by Sherlock and is insured for $5 million.

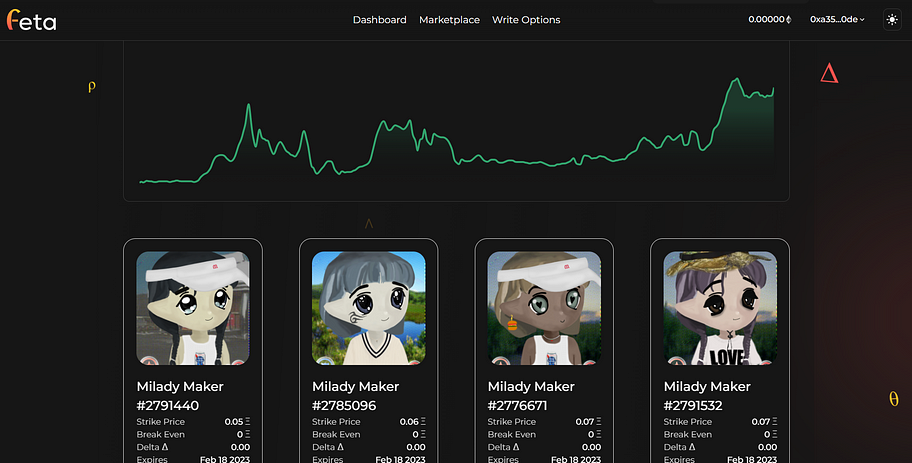

Fetα(https://testnets.feta.market/)

Fetα is a zero-fee NFT options marketplace built on Ethereum, where users can trade the top 20 blue-chip NFT options. Currently, Milady Paper call and put options are available for trading in the beta phase, and the protocol does not trade on a particular NFT series floor price, but is broken down to one of the NFT series. Users can price options with the assistance of the officially recommended pricing model. In addition to Covered Call, option sellers will be able to earn fees in the future by selling WETH covered puts. Furthermore, Fetα has confirmed the release of FETA Token as part of the DAO governance to vote on improvement proposals.

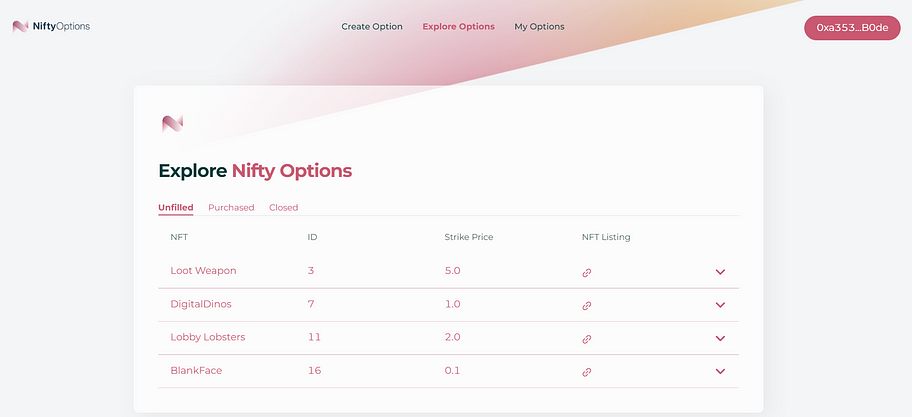

Nifty Options(https://niftyoptions.org/)

Nifty Options claims to be the first NFT option protocol on Ethereum, supporting the creation of options on a specific NFT from 15 NFT assets such as BAYC, 0N1 Force, Cool Cats, etc. It is essentially a sell put option operation that requires user-defined settings for options premium amount, strike price and expiration date. At the same time, users can also buy puts created by NFT holders in the market.

For example, let’s say A buys a BAYC for 75 ETH, in order to hedge, A can deposit the BAYC into Nifty and set (sell) a put option with a option premium of 1 ETH, a strike price of 60 ETH and a 6-month expiration date. All users in the market like B can get 1 ETH immediately by fulfilling the option provided B deposits 60 ETH (strike price) in the Nifty until the expiration date. B exercising the option will in any case retain the 1 ETH incentive as a reward for locking up the managed ETH and may lose it to obtain the NFT. Prior to the Expiration Date, if Option Creator A cancels the Option, 60 ETH will be returned to Exerciser B; if the Option is exercised, Option Creator A receives 60 ETH and Exerciser B receives NFT. After the expiration date, if there is no action by Option Creator A, the option may be cancelled by either User B, who exercised the option, or any other user in the market, and the NFT is returned to Option Creator A and the ETH is returned to Exerciser B. If the option is exercised, the NFT is returned to Option Creator A and the ETH is returned to Exerciser B.

Wasabi(https://wasabi.xyz/en/home)

Wasabi is a peer-to-peer decentralized NFT Covered options protocol built on Ethereum and is currently in beta testing on a whitelist system, scheduled to go live at the end of the first quarter. Wasabi mints option positions via the ERC 721 standard, so users purchasing options receive an ERC 721 Token representing their option. Users can exercise these ERC 721 Tokens before the expiration date; even if they expire, users can keep them, but without any functionality. Users can also use Wasabi options to create Wasabi pools, which can be used to create leveraged long or short ETFs. In addition, Wasabi’s settlement system is independent of the NFT floor price, and it is ultimately up to the option holder to decide whether or not to exercise the option, regardless of the floor price.

Wasabi is holding a test net trading contest between January 5 and March 15, where the top finishers will have a chance to win ETH and Wasabi NFT and whitelist rewards, and Wasabi NFT will be an important weighting in future Token airdrops.

Decalls(https://www.decalls.io/)

Decalls is the first NFT options trading platform built on Solana by the Yawww team, Solana’s P2P NFT trading automated hosting platform. Decalls launches on the Solana mainnet on February 14, and will be extended to Ethereum in the future. The platform allows users to participate in blue chip NFT options trading on the Solana for as low as 0.1 SOL. In addition, Decalls will issue 15,000 Future Traders NFTs and all revenues from the platform will be shared with Future Traders holders, with the team retaining 10% of the Future Traders NFT supply to cover the cost of doing business.

It is undeniable that despite the growth in PFP, Marketplaces, and lending, NFT as a whole is still at a very early stage, and the NFTFI derivatives track is even earlier with considerable uncertainty. How to expand incremental users and manage liquidity is still the main issue of the NFT track. If the experience of CEX futures trading is eventually considered to be applicable, NFT derivatives will have the potential to leverage a larger body of users, including professional traders and market makers, to participate in blue chip trading and drive skillful changes in NFT trading strategies, then this area will be a value pit.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish