WuBlockchain recently published a review of the regulatory assault on BUSD, in which the U.S. Securities and Exchange Commission (SEC) sued Paxos for using BUSD as an entry point for unregistered securities, and the New York State Department of Financial Services instructed Paxos to stop minting new BUSD. CZ also said, “We will adjust our products accordingly. For example, BUSD is no longer used as the primary currency counterpart for transactions “.

It can be predicted that BUSD will gradually fade from the stage of stablecoin history. Given that BUSD is the ace stablecoin of BNBChain, what will happen to the stablecoin ecology of BNBChain after BUSD’s exit?

Status of BNBChain’s stablecoin ecosystem

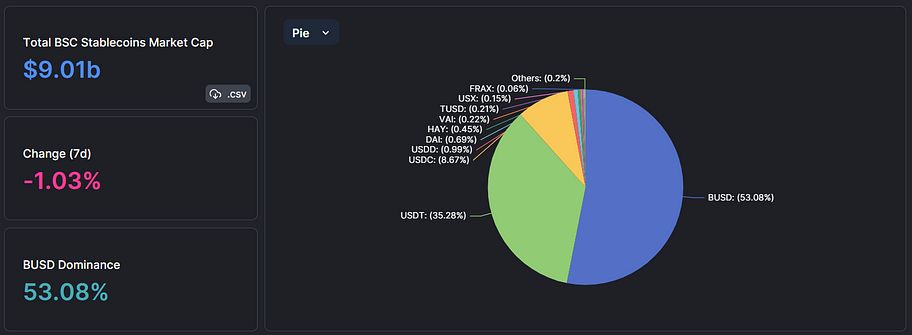

According to defillama, the total market cap of the stablecoin ecosystem on BNBChain is now over $9 billion, with BUSD having a 53% share and a market cap of about $4.8 billion.

This is followed by USDT with a market cap of about $3.2 billion (35%), USDC with a market cap of about $780 million (8.67%), and a number of stablecoins with market caps below $100 million such as USDD, Dai, and HAI.

According to Paxos, BUSD can still be redeemed until at least February 2024. Although there is a cushion of at least a year, the question before us is how this will shake up the BNBChain stablecoin ecosystem in the face of billions of dollars of stablecoin outflows.

● Is it to stimulate the development of decentralized stablecoins?

● Or strengthen the dominance of USDT/USDC in BNBChain?

For the former, CZ has responded to the suggestion that Binance itself should building a decentralized stablecoin similar to DAI, saying that at this point, “we would prefer someone else to do it to make it more decentralized. We can’t do everything.”

Two players in this sector, HAY and VAI, have a current market cap of only tens of millions, even if we are optimistic and imagine that this kind of project can succeed, it seems that their own sector also has a ceiling, For example, on ethereum, DAI’s market cap is only about 5 billion dollars. Converted to BNBChain, it still cannot match the scale of the centralized stablecoin like BUSD.

So for now, it seems to make the most sense for USDT/USDC to inherit the share of stablecoin that BUSD exits. But what we need to know here is that actually USDT/USDC officially does not issue native stablecoins on BNBChain, and even strictly speaking, BNBChain does not have native centralized dollar stablecoins, including BUSD, which is essentially a Binance Peg Token. Binance officially holds the native asset (i.e., BUSD on Ethereum) and then issued BEP20 tokens which is 1:1 peg with native assets on the BNBChain.

Binance-Peg Token(BToken)

Since most users only need to focus on the application experience, they don’t have a deep understanding of the underlying properties of each asset. In fact, when BNBChain (originally named BSC) was launched, Binance initiated the Token Canal plan in order to attract external high-quality Assets such as BTC\ETH and stablecoin, which was essentially similar to Wrapped Assets. Binance officially acts as the processing center for the custody and redemption of this original asset.

Later, with the introduction of diversified assets and the expansion of scale, Binance formally referred to these tokens as Binance-peg token or BToken.

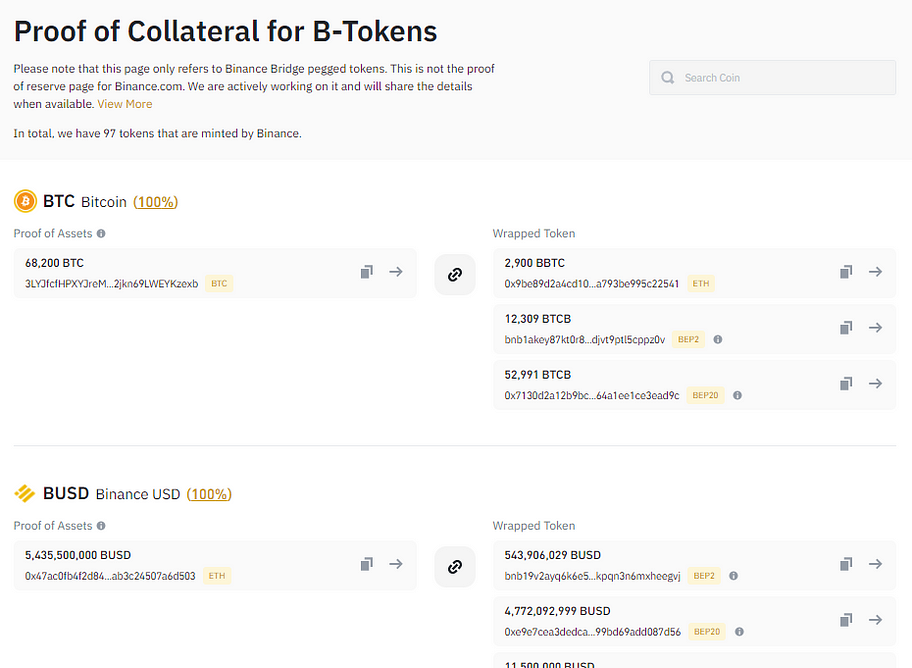

According to Binance’s official proof of collateral for BToken, we know that there are currently 97 Btokens, including about 5.4 billion ERC20 BUSD reserves, corresponding to about 4.8 billion BEP20 BUSD and the corresponding BUSD of other chains.

Previously, NYDFS emphasized that it authorized Paxos to issue BUSD on the Ethereum blockchain, but the department has not authorized Binance-Peg BUSD on any other blockchains. It seems that the real motivation for NYDFS is actually Binance Pegged BUSD, but probably not in the context of concerns about having 100% reserve backing either, as it can be validated by transparent reserves. Binance Pegged BUSD, a wrappered asset, strictly belongs to Binance’s on-chain behavior. So should NYDFS/SEC point to Binance? USDT\USDC also has corresponding Binance pegged. Will Tether\Circle have the same problem passively? Or is it just an excuse, the essence is just a kind of targeting? Of course, even if it is a target, it may also be related to the initial full support of Binance BUSD, the default automatic conversion of USDC, USDP, TUSD to BUSD. After all, under the support of Binance, More BUSD scenarios may be biased towards BNBChain, creating a misconception that Binance Pegged BUSD is the native asset.

Now, back to the original question, “How will BUSD’s exit stir up the BNBChain stablecoin ecosystem?” The answer seems to be quite clear. There will be some boost to the decentralized stablecoin sector, but the potential waves will be limited in height. There is a high probability that Binance Pegged USDT\USDC will gain market shares. Meanwhile, the gradual withdrawal of BUSD may also be negative for BNBChain ecology. Concerns over whether Binance Pegged USDT\USDC will be subject to the same regulatory restrictions on “issuance” authorization can be put to rest for now. While Binance-Peg Tokens does not have a compliant custodian license like WBTC’s custodian BitGo, its custodian reserves are public and transparent. Regulation should not be so sweeping.

Related data link:

https://www.bnbchain.org/en/blog/binance-presents-project-token-canal-2/

https://www.binance.com/en/collateral-btokens

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish