ETH Liquid Staking

We know that the staking threshold for validators on the Ethereum mainnet is 32 ETH, and before the upgrade in Shanghai is completed to activate the withdrawal function, ETH staked cannot be withdrawn. As network validators, there is also the possibility of being penalized due to technical issues or malfeasance. These layers of financial and technical barriers make ordinary ETH holders reluctant to participate.

Later, the rise of liquid staking derivatives protocols, represented by Lido, solved this pain point. The LSD protocol allows retail investors to participate in staking and receive rewards without maintaining staking nodes or other infrastructure. While users stake ETH, the LSD protocol indirectly releases the liquidity of locked ETH on the chain by issuing corresponding amounts of derivative tokens.

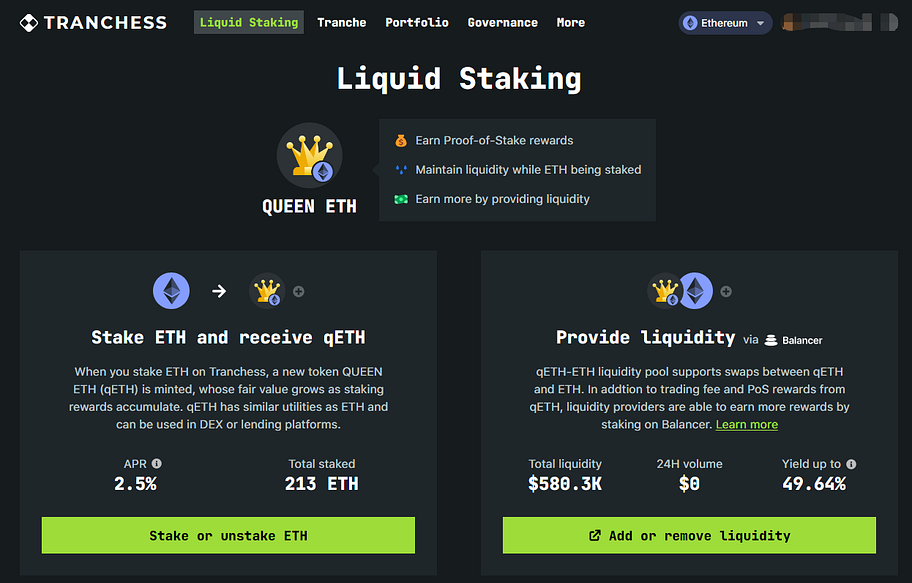

On November 25, 2022, Tranchess officially launched on the Ethereum mainnet, ushering in the era of multi-chain deployment, and launched its ETH liquidity staking service, qETH.

qETH is the liquidity token corresponding to Tranchess’s Ethereum liquid staking service. When users stake ETH through Tranchess, they receive qETH as liquidity tokens. If users do not perform additional staking/unstaking operations, the amount of qETH held by users will be fixed, and the staking rewards will be accumulated as the fair value of qETH (i.e., the ETH Fund) and ultimately reflected in the qETH/ETH exchange rate. 90% of the staking rewards will enter the ETH Fund to enhance the fair value of qETH. The other 10% will be protocol revenue, with 7% going to the protocol’s income and 3% as validator reward fees.

Tranchess not only allows users to earn staking rewards on Beacon Chain, but they can also provide liquidity in the Tranchess qETH/ETH pool on Balancer. LPs earn boosted BAL incentives or further enhance their earnings through other platforms in the Balancer ecosystem. For example, LPs can earn both Aura and BAL rewards by staking on Aura.

The combination of qETH and the tranche fund model

Tranchess is well-known for its structured products, specifically its tranched funds, which offer multiple risk/reward matrices derived from a single main fund. The main fund tracks a specific underlying asset and can be split into two sub-funds. One sub-fund provides a high-yielding token for risk-averse investors, while the other sub-fund offers leveraged exposure to the underlying asset for risk-seeking investors. This provides diversified investment options for investors with different risk preferences.

In Tranchess’ case, there are three tranched tokens (QUEEN, BISHOP, and ROOK), each catering to a specific group of investors: QUEEN for spot exposure, BISHOP for stablecoin/hedging exposure, and ROOK for leveraged exposure.

Some readers may have already noticed that Tranchess’ qETH is actually QUEEN ETH. With the launch of eBISHOP and eROOK on Ethereum’s mainnet on February 16, Tranchess has completed the layout of its LSD ecosystem’s three project tokens. To help readers understand, we’ll provide an overview of Tranchess’ tranched funds that have been operating stably on the BNB Chain for the past two years.

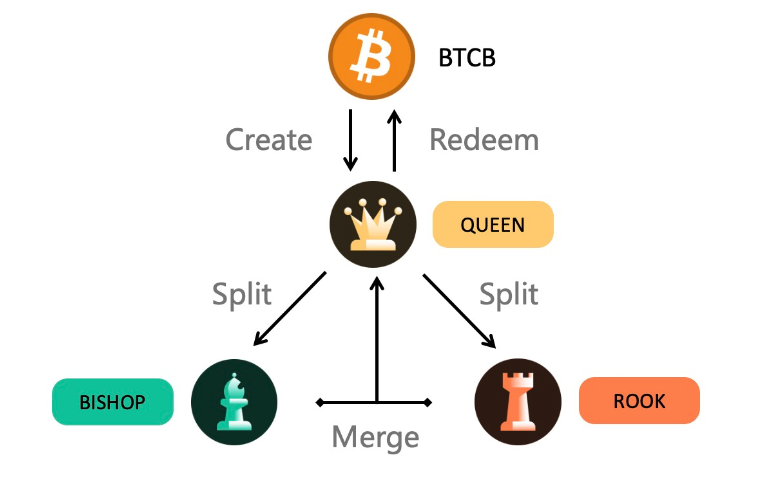

Tranchess currently has three main funds on the BNB Chain: BNB, BTCB, and ETH. Let’s take BTCB as an example to explain Tranchess’ implementation mechanism.

Users can stake BTCB on the BNB Chain to mint QUEEN tokens at a 1:1 ratio. QUEEN can be split into BISHOP and ROOK, and users holding QUEEN can choose whether to split it. One QUEEN can be split into equal portion of BISHOP (for fixed income sub-fund) and ROOK (for leveraged sub-fund), and BISHOP and ROOK can be merged back into QUEEN.

Similarly, on the Ethereum mainnet, with the launch of eBISHOP and eROOK, qETH holders will have several investment options:

● Continue to hold qETH: equivalent to participating in ETH staking, but with instant liquidity and the ability to earn rewards by providing qETH as liquidity in LP tokens.

● Split and only hold eBISHOP: BISHOP is a risk-free token that is actually a high-yield product in the DeFi context and belongs to a stablecoin-like category. BISHOP holders earn interest from ROOK holders. In other words, BISHOP holders lend their asset position to ROOK holders, allowing them to gain leveraged exposure and earn interest. Additionally, on the Ethereum mainnet, eBISHOP will receive a portion of the qETH staking rewards, the specific proportion of which depends on the voting of the veCHESS holders.

● Split and only hold eROOK: equivalent to holding a leveraged token close to 2x long ETH, and due to the rebalancing mechanism, there is no forced-liquidation risk. Additionally, eROOK can also receive a portion of the staking rewards.

Conclusion

With the successful completion of Shanghai’s upgrade, the previously calm LSD sector has once again become a battleground. Centralized exchanges and top protocols such as Lido and Rocket Pool, which previously occupied a large market share through first-mover advantages, will undergo a reshuffle after the upgrade. Meanwhile, the huge business volume potential of LSD itself continues to attract various players. Currently, we can see SSV Network and Obol Network with “Distributed Validator Technology (DVT)” and EigenLayer with “Re-Staking” on the Ethereum mainnet. The potential market for tranche funds is yet to be explored, and with the added support of Ethereum staking rewards, we await to see how Tranchess contributes to the diversity of the market with its unique niche.

Disclaimer: This article is sponsored by Tranchess, does not represent the view of WuBlockchain, and does not constitute financial advice. Readers are requested to strictly abide by the laws and regulations of their jurisdictions.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish